All

EIA: Renewable Diesel Growth at Expense of Biodiesel

Forecast sees Low Carbon Fuel Standards and RFS changes fueling growth of renewable diesel

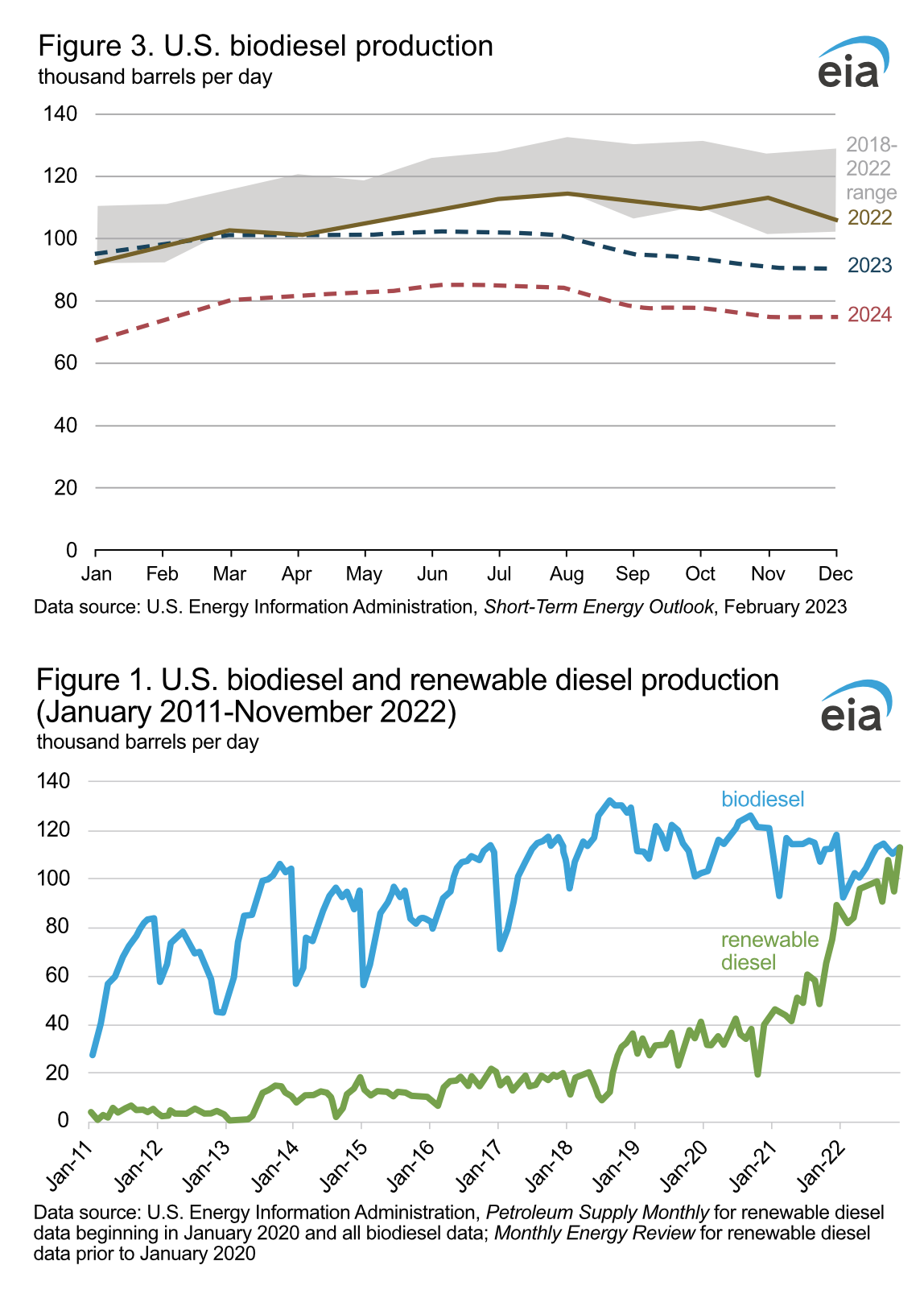

In February, the U.S. Energy Information Administration (EIA) reported that, according to its January Petroleum Supply Monthly report, renewable diesel production surpassed biodiesel production in November 2022 for the first time since the organization began reporting on renewable diesel production data in its Monthly Energy Review.

Renewable diesel production in November 2022 averaged 113,000 barrels per day (b/d), a 38,000 b/d (51%) increase from November 2021 and a 74,000 b/d (191%) increase from November 2020. The EIA forecasts renewable diesel production to continue to grow and remain higher than biodiesel production, which it expects to decrease.

Biodiesel and renewable diesel are used to comply with the biomass-based diesel renewable volume obligations in the Renewable Fuel Standard (RFS) administered by the U.S. Environmental Protection Agency (EPA). They also supply 95% or more of the RFS requirement for non-cellulosic advanced biofuels.

Government programs and subsidies for lower-carbon fuels are driving growth in renewable diesel production. Renewable diesel has been increasingly used to meet California’s Low Carbon Fuel Standard (LCFS), Oregon’s Clean Fuels Program, and the RFS. It will also help meet the requirements of Washington State’s Clean Fuels Program, which launched on January 1, 2023. In addition to these government programs, biomass-based diesel tax credits, which the Inflation Reduction Act of 2022 extended through 2024, have made production of renewable diesel more economical. These programs have provided incentive to build new renewable diesel plants, including Diamond Green Diesel’s plant in Port Arthur, Texas, and several plants at sites of former petroleum refineries, such as Marathon Petroleum’s Dickinson, North Dakota refinery; Phillips 66’s Rodeo, California refinery; and HF Sinclair’s Cheyenne, Wyoming refinery.

In the EIA’s February Short-Term Energy Outlook (STEO), it forecast that renewable diesel production will continue growing as production capacity increases. The EIA estimates that renewable diesel production in 2022 averaged 97,000 b/d, an increase of 41,000 b/d (73%) from 2021 and forecast that renewable diesel production will average 148,000 b/d in 2023, an increase of 50,000 b/d (52%) from 2022, and 211,000 b/d in 2024, an increase of 63,000 (42%) from the forecast for 2023. The forecast shows renewable diesel production reaching 177,000 b/d at the end of 2023 and 252,000 b/d at the end of 2024.

Despite this growth, the EIA forecasts U.S. renewable diesel production to remain well below the 357,000 b/d of planned production capacity shown for 2024 in the February 2 Today in Energy article for three reasons:

- The significant ramp-up in production capacity will likely increase feedstock prices, which would make renewable diesel production less profitable and could decrease plant utilization or result in some canceled planned capacity.

- Some planned capacity may come online later than planned.

- New plants will take several months before producing at full capacity.

Because biodiesel producers compete for the same constrained feedstocks as renewable diesel producers, the EIA expects U.S. biodiesel production to decrease as renewable diesel production increases. Biodiesel production generates fewer RIN credits per gallon than renewable diesel, and biodiesel is primarily transported by rail and truck, which are more expensive than pipeline transportation.

The EIA anticipates that high feedstock prices will moderate biodiesel profits and either reduce biofuel plant utilization or push less economically efficient biodiesel plants into retiring. U.S. biodiesel production capacity has already begun to decrease, according to its January 2023 Monthly Biofuels Capacity and Feedstocks Update, which includes biodiesel production capacity data through November 2022. U.S. biodiesel production capacity averaged 136,000 b/d in November 2022, which was 19,000 b/d (12%) less than in November 2021. This decrease in biodiesel production capacity is likely a result of less efficient biodiesel plants losing profitability in the high feedstock price environment. The forecast assumes that feedstock prices will remain high or rise in the short term and that more biodiesel capacity will retire.

As renewable diesel production grows, the EIA also expects growth in the production of sustainable aviation fuel (SAF) and other biofuels that it captures in its “other biofuels” production data. U.S. production of these other biofuels is expected to more than double from 2022 by 2024. Much of this growth will come from the renewable naphtha and renewable propane produced as coproducts of renewable diesel production and from the SAF produced at renewable diesel plants that plan to produce both. Because renewable diesel plants can produce other biofuels, increases in renewable diesel production will facilitate a portion of the forecast increase for other biofuels production.

Related Posts

Why Quality Matters in Your Biofuel Blends

Why Quality Matters in Your Biofuel Blends

Posted on June 25, 2025

Incorporating Higher Blends of Biofuels

Incorporating Higher Blends of Biofuels

Posted on May 14, 2025

NORA Programs at Eastern Energy Expo

NORA Programs at Eastern Energy Expo

Posted on May 13, 2025

March Short-Term Energy Outlook

March Short-Term Energy Outlook

Posted on April 28, 2025

Enter your email to receive important news and article updates.