Heating oil marketers got some good news last month when the U.S. Energy Information Administration (EIA) predicted that heating oil costs would drop this winter while natural gas heating costs would rise.

EIA forecasted household heating costs in its annual Winter Fuels Outlook, saying that natural gas heat will cost 13 percent more this winter if the weather plays out according to the government’s winter forecast. If the weather is 10 percent colder than forecast, natural gas heat costs will rise by 25 percent.

The Winter Fuels Outlook calls for heating oil costs to decrease by 2 percent if the government’s forecast is accurate. A winter that is 10 percent warmer than the base forecast would lead to a 13 percent reduction in heating costs. A winter that is 10 percent colder than the forecast would cause a 9 percent increase in heating costs.

The EIA predicts that propane heating will cost 9 percent more this winter than last winter. (The agency did not offer alternative pricing scenarios based on weather variations for propane heating.)

Natural Gas Supply Crunch

Natural gas costs in the Northeast region are expected to rise more than national average, with the average gas-heated household facing an 18 percent cost increase, according to EIA. The region’s reliance on natural gas for electricity generation has increased from 30 percent to 52 percent over the last 11 years.

“Increased gas use for power generation has contributed to pipeline transportation constraints in the New England regional natural gas market,” EIA reports. “These pipeline constraints are more pronounced in winter months and contributed to extreme price spikes in spot natural gas and electricity prices in New England during January and February 2013.

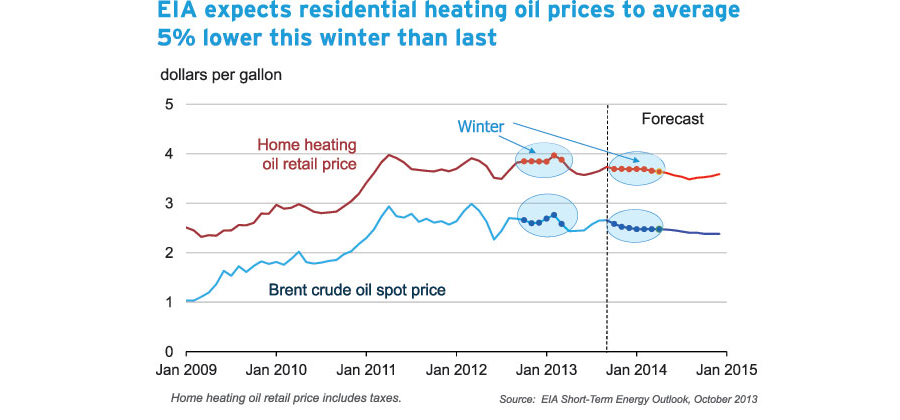

EIA is projecting the retail price of heating oil to average $3.68 per gallon this heating season (October 2013 to March 2014). This price would be 19 cents per gallon lower than the average price during the winter of 2012-13 and reflects EIA’s lower price forecast for Brent crude oil. This winter, EIA expects Brent crude oil to average $105 per barrel ($2.50 per gallon), about $6 per barrel (14 cents per gallon) lower than last winter.

Distillate Demand

While U.S. distillate production is high and prices and expenditures are expected to be lower than last year, the global supply-demand balance for distillate fuels has created a price structure that has not encouraged inventory builds, according to EIA. Strong demand abroad for distillate fuel, particularly in Europe and Latin America, resulted in record levels of U.S. exports over the summer. That demand has pushed up prompt prices for distillate futures contracts, which have been trading at a persistent premium to those for delivery further in the future.

For the week ending September 27, distillate inventories in the U.S. Northeast were 29.4 million barrels, about 17.3 million barrels (37 percent) below their five-year average level, but only 0.9 million barrels below end-of-September 2012 levels. Distillate inventories have historically been used to meet normal winter heating demand but are also an important source of supply when demand surges as a result of unexpected or extreme cold spells. The low distillate inventories could contribute to heating oil price volatility this winter.