The latest forecasting from the U.S. Energy Information Administration (EIA) anticipates higher crude oil prices in late 2023 and into 2024. This upward pressure will be caused by “moderate but persistent” inventory drawdowns to offset production cuts from OPEC+, Saudi Arabia and Russia.

EIA anticipates Brent crude oil to land in the “mid-$80 per barrel range” by the end of 2024, with West Texas Intermediate crude following a similar trajectory with about a $5 per barrel discount off of Brent.

In April 2023, OPEC+ announced production cuts that were to continue through the end of 2023. In June, those cuts were extended through December 2024, and were followed with an announcement from Saudi Arabia of an additional voluntary production cut of 1.0 million b/d for July and August and one from Moscow reducing exports by 500,000 b/d. It should be noted that in July, the price for Russian crude oil topped the $60/b cap imposed by the United States and European partners for the first time.

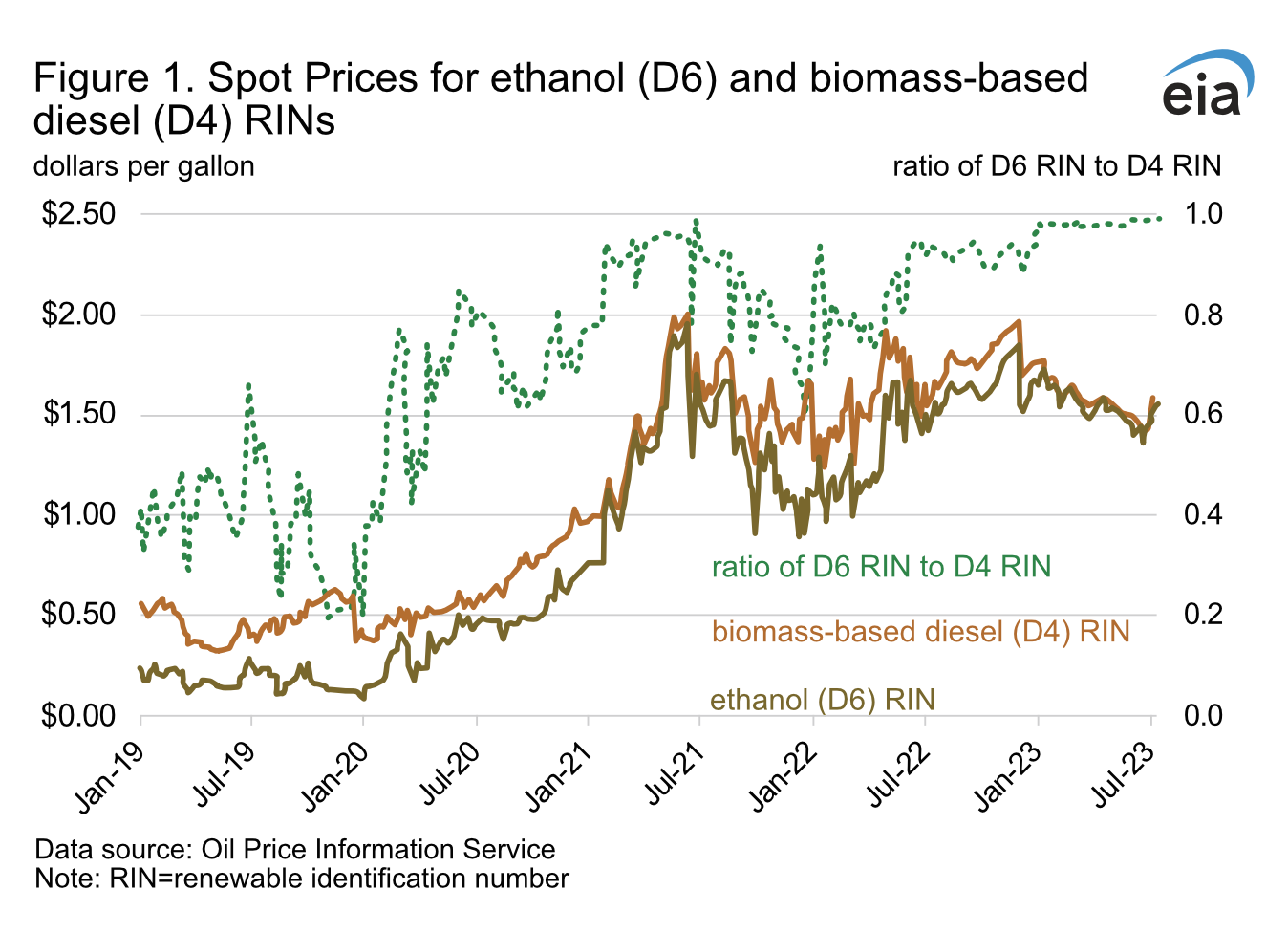

On the Renewables side, the EIA is reporting drops in RINS values upon the EPA’s release of RFS volumes. The value of a RIN credit is the price the biofuel plants and fuel blenders both need as an incentive to produce and blend at levels suitable for RFS compliance. However, high production of renewable diesel and increases in biodiesel imports have resulted in RIN generation that is expected to significantly exceed the required targets in the RFS. In general, RIN credit prices are driven by renewable volume obligations set under the RFS and agricultural feedstock costs.

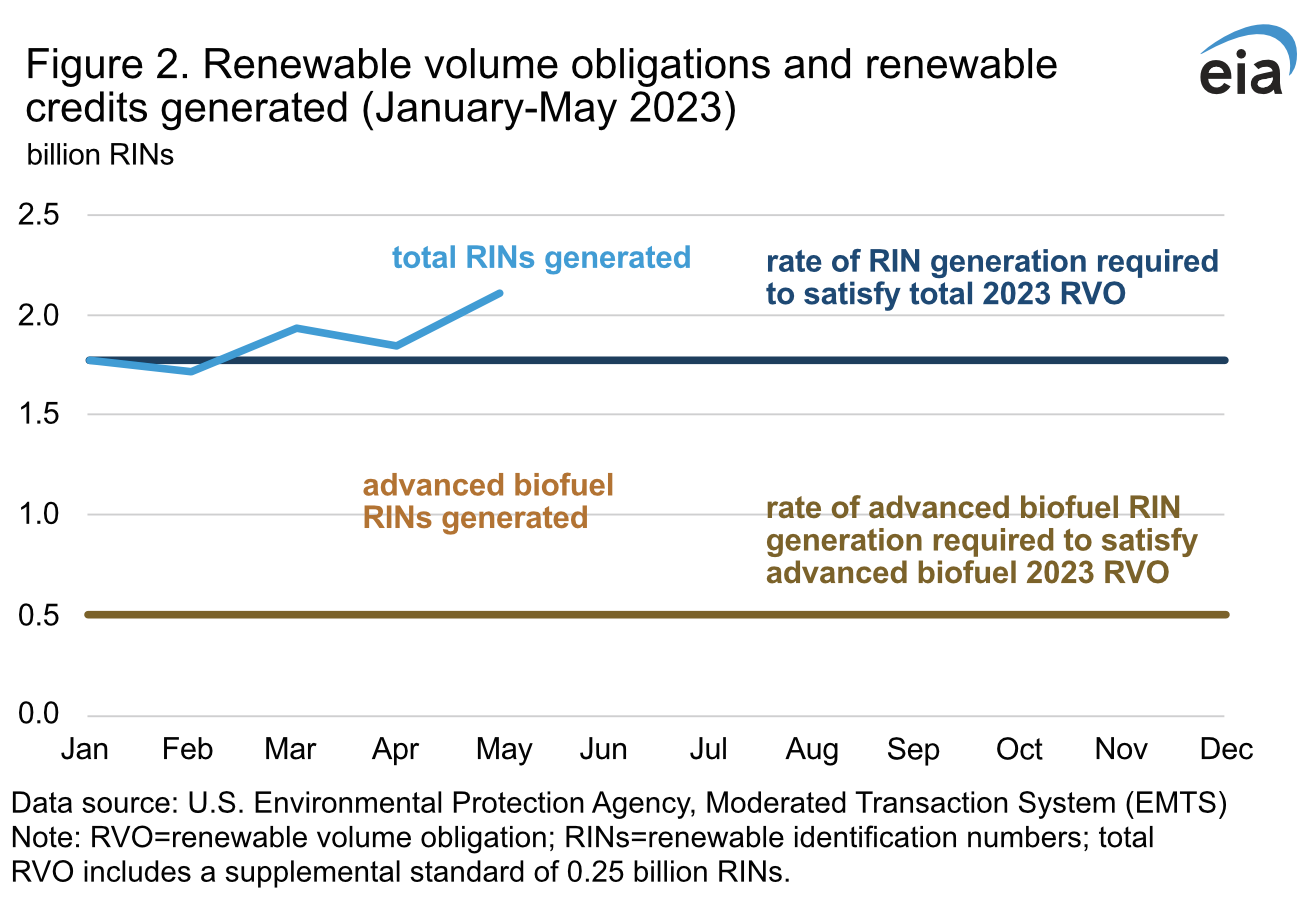

The RFS did not significantly affect RIN prices until June 21, when the EPA announced its final rule setting the advanced biofuel obligation (which can be met by blending cellulosic biofuel or biomass-based diesel into petroleum-based fuels) for 2023 at 5.94 billion RINs and the total renewable volume obligation for 2023 at 21.19 billion RINs. Current rates of biofuel production have exceeded the volume obligations. To reach 5.94 billion advanced RINs, obligated parties must retire an average of nearly 0.50 billion RINs per month. To reach 21.19 billion total RINs, obligated parties must retire an average of nearly 1.77 billion RINs per month. Those averages have been exceeded in 2023 as of the end of May because of increasing renewable diesel production. In May 2023, a record 0.83 billion advanced biofuel RINs and 2.11 billion total RINs were generated.

On June 21, the D4 RIN decreased from $1.48 to $1.38, and the D6 RIN decreased from $1.45 to $1.35. However, since June 21, RIN prices have generally increased, likely because soybean oil prices have increased by more than $1.00/gal. Soybean oil prices had been dropping through May of this year on forecasts of record soybean production. The June and July droughts in the Midwest initiated a reassessment of supplies and production, with a subsequent increase of $1.23 per gallon. Higher feedstock prices increase the cost to produce biodiesel and renewable diesel, which required increase in RINs pricing to make production profitable.

In response to the final RFS rule and recently increasing feedstock costs, the EIA now assumes lower plant utilizations and more proposed plants to be canceled than before, but still expects production growth based on the assumption that some previously announced projects will come online in the next 18 months.