All

Do. Not. Substitute.

by Rick Schweitzer, NEFI Regulatory Counsel

Dealers may incur fines for using or selling heating oil as diesel

Recently, price differentials between the costs of fuels have prompted some dealers to ask if they may legally use heating oil as on-road or off-road diesel, or if they can legally market and sell heating oil for these uses.

As a reminder, companies may not substitute heating oil for on-road diesel fuel. Heating oil is purchased tax-free, and therefore is dyed red to differentiate it from tax-paid diesel fuel used in on-road vehicles. On-road diesel is clear or light green. Federal and state regulators conduct spot checks on a frequent basis to ensure that fuel used in on-road applications is not dyed red and therefore tax-paid. If an investigator finds dyed fuel in a vehicle’s tank, the operator could be subject to a penalty that runs from $100 to over $1,000 for a gallon of fuel. The individual might also end up owing excess taxes and interest for unpaid taxes to the Internal Revenue Service and state tax authorities.

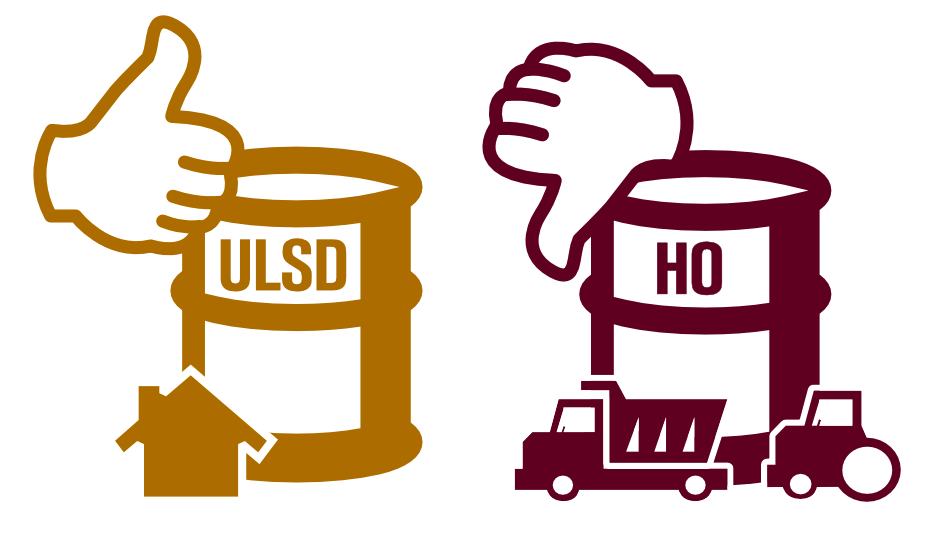

Diesel for use in off-road vehicles and equipment is also sold tax-free and dyed red to denote its tax-free status. So, the question has arisen whether you may substitute heating oil for off-road diesel, especially if they both meet the 15 ppm standard for ultra-low sulfur content. Substituting higher sulfur content heating oil for off-road diesel can void the warranty for off-road vehicles or equipment and damage the engines. You may, however, use ULSD as heating oil. But even when the sulfur content of heating oil meets the 15 ppm standard, you may not freely substitute heating oil for off-road diesel due to the Renewable Fuel Standards of the Environmental Protection Agency and similar state agencies.

The EPA’s Renewable Fuel Standard policy requires a certain volume of renewable fuel to replace or reduce the quantity of petroleum-based transportation fuel, heating oil or jet fuel. The law requires 36 billion gallons of renewable fuel to replace petroleum-based fuel in 2022. The four renewable fuel categories under the RFS are biomass-based diesel, cellulosic biofuel, advanced biofuel, and total renewable fuel.

Obligated parties under the RFS are refiners or importers of gasoline or diesel fuel. Compliance is achieved by blending renewable fuels into transportation fuel, or by obtaining credits (called Renewable Identification Numbers or RINs) to meet an EPA-specified Renewable Volume Obligation (RVO). EPA calculates and establishes RVOs every year through rulemaking, based on the Clean Air Act volume requirements and projections of gasoline and diesel production for the coming year. The standards are converted into a percentage, and obligated parties must demonstrate compliance annually.

But EPA guidance states: “The EPA believes that most biodiesel will ultimately be used as motor vehicle fuel, and therefore biodiesel producers can assume the biodiesel meets the EPA definition of renewable fuel and can assign RINs to it without tracking its ultimate use. However, if a renewable fuel is known to be destined for use in a non-road application, such as agricultural equipment or underground mining equipment, it’s not considered a motor vehicle fuel and isn’t a renewable fuel that is valid for RFS compliance, and thus can’t receive RINs. In cases where the fuel has been assigned RINs, those RINs must be retired and reported.”

Thus, heating oil and on-road diesel are subject to the RFS program, but off-road diesel is not. Using heating oil in off-road vehicles or equipment therefore violates the EPA’s RFS requirements and probably state requirements as well. Under federal law, violators are subject to a potential civil penalty of up to $47,357 per day of violation, plus the economic benefit or savings resulting from the violation.

Regulatory alerts like this are made possible only through generous contributions to the NEFI Advocacy Fund. To support NEFI, please make a donation at nefi.com/donate. To join, visit nefi.com/join. For more information, email regulations@nefi.com.

Related Posts

U.S. Competing to Secure Critical Minerals

U.S. Competing to Secure Critical Minerals

Posted on June 16, 2025

The Clean Air Act, the EPA, and State Regulations

The Clean Air Act, the EPA, and State Regulations

Posted on May 14, 2025

Day Tanks Support Back-up Generators in Extreme Conditions

Day Tanks Support Back-up Generators in Extreme Conditions

Posted on March 10, 2025

Major Breakthrough in Lithium-Ion Batteries

Major Breakthrough in Lithium-Ion Batteries

Posted on February 12, 2025

Enter your email to receive important news and article updates.