The desulfurization of distillate fuels continues this year. Before the Environmental Protection Agency (EPA) regulation began in 1993, diesel fuel contained up to 0.5% (5,000 parts per million or ppm) sulfur. EPA began phasing in more stringent regulations beginning in 2006, requiring 15ppm Ultra-Low Sulfur Diesel (ULSD) for on-road vehicles in 2010. Non-road diesel fuel standards from EPA tightened to require .05% (500ppm) Low Sulfur Diesel and then ULSD for non-road, locomotive, and marine (NRLM) diesel. Home heating fuel diesel limits began tightening in the U.S. Northeast with the state of New York requiring ULSD in July of 2012. Over the subsequent years, most Northeast states followed suit. This summer, Maryland is moving from a 500ppm sulfur specification for home heating to the 15ppm ULSD specification. As of this writing, it was unclear whether or not Pennsylvania was moving to ULSD – this would be the last remaining Northeast state not using ULSD (and only partially, as Philadelphia has already switched to ULSD). With this chapter closing, a new and potentially dramatic chapter in distillate fuel desulfurization is coming next year, when the new IMO 2020 rules requiring 0.5% (5,000ppm) sulfur marine fuels come into force.

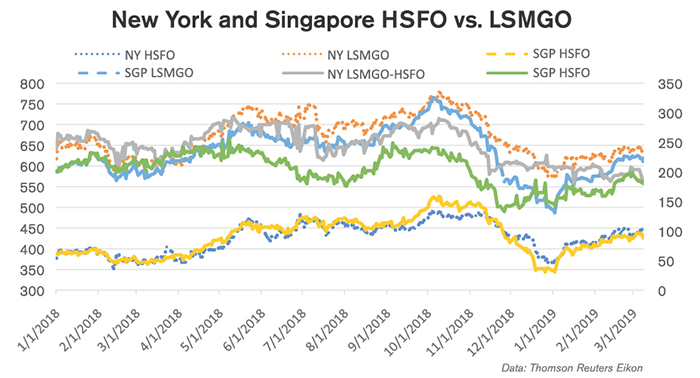

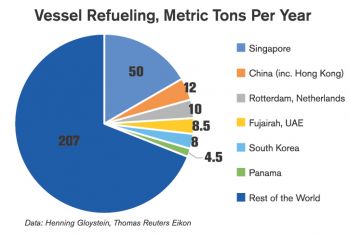

The International Maritime Organization (IMO) adopted the International Convention for the Prevention of Pollution from Ships (MARPOL Convention), which came into force in 2005, with Annex VI restricting sulfur oxide (SOX) emissions. Beginning on January 1, 2020, the sulfur limit for fuel used by ships operating outside of designated emission control areas (which remain at 0.1% or 1,000ppm sulfur) will fall from 3.5% (35,000ppm) to 0.5% (5,000ppm). In order to comply, ship owners will have to either run the more expensive low sulfur fuel or install expensive sulfur scrubbers. In the longer term, they could also convert to run on Liquefied Natural Gas (LNG). Scrubber adoption will depend on consumption and the spread between low-sulfur marine gasoil (LSMGO) and high sulfur fuel oil (HSFO). As Singapore is easily the top port globally for ship refueling, the HSFO-LSMGO spread at this location is of particular interest. Scrubbers are expensive, so 100% adoption is highly unlikely, meaning demand for low sulfur fuel is likely to spike.

The head of the oil industry and market division at the Paris-based International Energy Agency says he believes the “industry has already passed the date beyond the smooth transition” to the implementation of IMO 2020. McKinsey & Co. estimates global HSFO consumption was 3.5 million barrels per day (mb/d) last year, and Goldman Sachs puts demand at 3.3 mb/d in 2017. Norway’s SEB Bank says some 3 mb/d of demand for HSFO will “disappear overnight” due to IMO 2020. Apparent low scrubber adoption indicates the transition could, indeed, be disruptive. Manufacturing firm Wartsila puts the cost of scrubbers at between $1 million and $6 million, pricing this option out for many ship operators. Although shippers estimate some 3,000 of a required 60,000 scrubbers could be installed, this would have only a marginal effect, and most ships will have to shift to a lower sulfur fuel. IEA predicts that demand for HSFO could fall by 60% next year, from 3.5 mb/d to 1.4 mb/d.

Very Low Sulfur Fuel Oil (VLSFO) is being developed in order to meet the IMO 2020 regulations, but production seems limited initially, with the additional problem of varying quality by supplier. Most incremental shipper demand will therefore likely be for LSMGO/DMA, which is widely available but more expensive, and according to Shell brings thermal shock and lubricity issues. To meet this greater demand, refiners will have to raise low sulfur gasoil production. IEA expects global gasoil production will increase by 2.3 mb/d by 2024. This will not be without cost, however. In order to increase low sulfur distillate yields, refiners might need to install new hydrocracking and coking units, an upgrade that could cost $1 billion. Consultancy KBC estimates 40% of Middle Eastern and European refineries are not prepared. Another option is to buy sweeter (lower sulfur) crude oil feedstock, but this trades at a premium to sour. U.S. Gulf Coast refiners, due to their relative complexity and access to ample light, sweet shale oil production, are relatively well poised.

Very Low Sulfur Fuel Oil (VLSFO) is being developed in order to meet the IMO 2020 regulations, but production seems limited initially, with the additional problem of varying quality by supplier. Most incremental shipper demand will therefore likely be for LSMGO/DMA, which is widely available but more expensive, and according to Shell brings thermal shock and lubricity issues. To meet this greater demand, refiners will have to raise low sulfur gasoil production. IEA expects global gasoil production will increase by 2.3 mb/d by 2024. This will not be without cost, however. In order to increase low sulfur distillate yields, refiners might need to install new hydrocracking and coking units, an upgrade that could cost $1 billion. Consultancy KBC estimates 40% of Middle Eastern and European refineries are not prepared. Another option is to buy sweeter (lower sulfur) crude oil feedstock, but this trades at a premium to sour. U.S. Gulf Coast refiners, due to their relative complexity and access to ample light, sweet shale oil production, are relatively well poised.

A final option for shippers is noncompliance. Estimates of how much cheating there might be vary, from as low as 10% to as high as 40%. IMO aims to ban ships that do not have scrubbers from carrying HSFO, making it easier to identify cases of noncompliance. While noncompliance may dull the impact of the transition to some degree, it is still likely to be disruptive, not only for refiners as previously mentioned, but for many other sectors due to higher shipping costs. Wood Mackenzie estimates global shipping fuel costs could rise by 25% or $24 billion next year. Additionally, the jump in distillate demand is likely to support jet fuel and diesel prices as well.

The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.