The following article originally appeared in the February 21 edition of Today In Energy, published by the U.S. Energy Information Administration, under the heading, “Recent legislation mandates additional sales of U.S. Strategic Petroleum Reserve crude oil.”

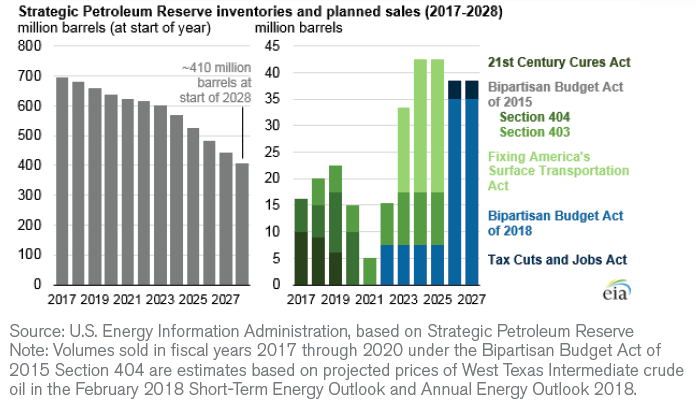

Recent legislation has directed the sale of more than 100 million barrels of oil from the U.S. Strategic Petroleum Reserve (SPR) in U.S. government fiscal years (FY) 2022 through 2027. Based on legislated sales established in multiple acts of Congress, the SPR could decline by about 40% in the coming decade while still meeting requirements for petroleum import coverage. Assuming no other legislation over this period, the SPR could decline from 695 million barrels at the start of 2017 to about 410 million barrels at the start of 2028.

The largest stockpile of government-owned emergency crude oil in the world, the SPR was established to help alleviate the effects of unexpected oil supply reductions. Located in four storage sites along the Gulf of Mexico, the SPR held more than 695 million barrels of crude oil at the beginning of 2017, or about 97% of its 713.5 million barrel design capacity. Prior to FY 2017 sales, the SPR inventory level had remained nearly constant for several years.

Three bills enacted in 2015 and 2016 — the Bipartisan Budget Act of 2015, 21st Century Cures Act, and Fixing America’s Surface Transportation Act — collectively call for the sale of 149 million barrels in FY 2017 through FY 2025. Most of these sales set volumetric requirements, and revenues from those sales go to the U.S. Department of Treasury. A section of one of those bills — Section 404 of the Bipartisan Budget Act of 2015 — included authorization for funding an SPR modernization program by selling up to $2 billion worth of SPR crude oil in FY 2017 through FY 2020. In that act, the sales are based on revenue targets that must be authorized by Congress.

Two recent congressional acts collectively call for the sale of 107 million barrels of crude oil in FY 2022 through FY 2027:

- The Bipartisan Budget Act of 2018, enacted in February 2018, calls for the sale of 30 million barrels over the four-year period of FY 2022 through FY 2025, 35 million barrels in FY 2026, and 35 million barrels in FY 2027.

- The Tax Cuts and Jobs Act of 2017, enacted in December 2017, calls for the sale of 7 million barrels over the two-year period of FY 2026 through FY 2027.

One of the SPR’s core missions is to hold enough oil stocks to carry out U.S. obligations under the International Energy Program (IEP), the 1974 treaty that established the International Energy Agency (IEA). Under the IEP, the United States must be able to contribute to an IEA collective action based on its share of IEA oil consumption. Based on the most recent shares, the United States must be prepared to contribute about 43% of the barrels released in an IEA coordinated response. The United States government relies on the SPR to meet this requirement.

As a member of the IEA, the United States is obligated to maintain stocks of crude oil and petroleum products, both public and private, to provide at least 90 days of U.S. net import protection. As net imports of crude oil and petroleum products into the United States continue to decline, this requirement can be met with lower SPR inventory levels. The Reference case of EIA’s latest Annual Energy Outlook projects that the United States will be a net exporter of petroleum by 2029. Other cases with more domestic petroleum production show the United States reaching net petroleum exporter status even sooner.

Based on November 2017 levels of net crude oil and petroleum product imports, the SPR alone holds crude oil stocks equivalent to 252 days of import protection. Private (commercial) stocks of crude oil provide an additional 452 million barrels, equivalent to another 172 days of import protection.