All

Canada Passes Clean Fuel Regulation

USDA issues update on new legislation

After more than six years of development, Canada’s Clean Fuel Regulation (CFR) became law on July 6, 2022. It aims to expand the use of low carbon fuels in the transportation sector, both lower carbon fossil fuels and biofuels whose carbon intensity is incentivized to fall as well. It is widely expected to significantly change the transportation fuel-mix in Canada. As a market-oriented program for change, with features similar to U.S. West Coast programs and British Colombia, the speed of change and future mix of fuels at any point in time are challenging to predict.

Canada’s CFR encourages the use of low carbon-intensity (CI) fuels by limiting the CI of transport fuels delivered to the market to a lower value each “compliance year” (calendar year).

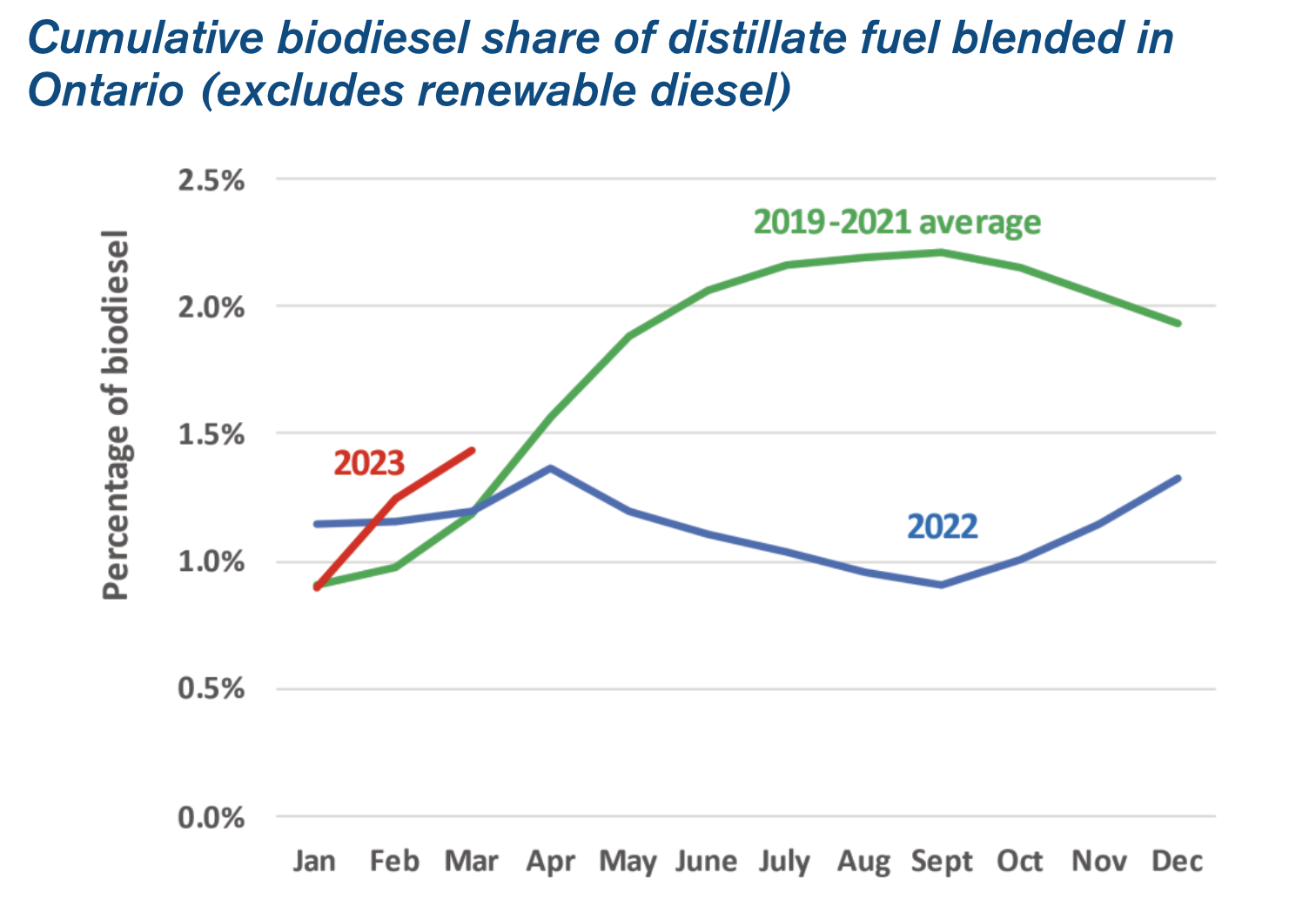

In addition to stimulating increased use of lower CI biofuels and displacing fossil fuels, the CFR will alter the fuel mix in Canada by prioritizing the use of the lowest CI fuels (such as renewable diesel) relative to the other renewable fuels available in larger volumes, namely ethanol and biodiesel.

Fuel ethanol consumption increased an estimated 20 percent in 2022, year-over-year, to 3.4 billion liters. This increase was driven by anticipation of the CFR’s implementation, Quebec’s new volumetric requirements for low-carbon fuel content, and volumetric requirements in Ontario.

Canada is the United States’ top market for renewable fuel and accounts for over half of all U.S. ethanol and bio-based diesel (biodiesel and renewable diesel) exports, valued at USD $2.8 billion in 2022. Canadian imports of U.S. fuel ethanol increased 40 percent in 2022, year-over-year, to 1.76 billion liters. In value terms, imports increased 53 percent to USD $1.3 billion. This increase was primarily driven by higher blending levels, especially in Ontario which consumed more ethanol blended gasoline than any other province.

In 2023, imports of U.S. fuel ethanol are forecast at a record 2.3 billion liters mainly due to a further increase in blending and further post-Covid recovery in demand for light-duty vehicles.

U.S. federal biofuel policy (RFS obligations to meet volumetric obligations for various biofuels, the value of RINs Canadian biofuels is permitted to generate) and hefty tax credits (mostly federal) for biomass-based diesel continue to influence Canada’s biofuels market and trade with the United States. Canada’s fuel ethanol imports from the United States have accounted for about 40 percent of Canadian consumption and are now exceeding 50 percent, while the vast majority of biodiesel produced in Canada is shipped southward and then backfilled by U.S. biodiesel consumed in Canada.

Corn mainly but also wheat are the feedstocks used to produce ethanol in Canada, while canola oil, vegetable oil, and some used cooking oil and tallow are used to produce bio-based diesel. Canola oil use is expected to increase further as the primarily feedstock for Canada’s diesel industry and also renewable diesel industry as production for both expand under the CFR.

In July 2022, the Government of Canada published the final CFR in Canada Gazette Part II. An ECCC news release published June 30, 2023, states that the CFR will cut “up to 26.6 million tons of emissions reduction annually by 2030.”

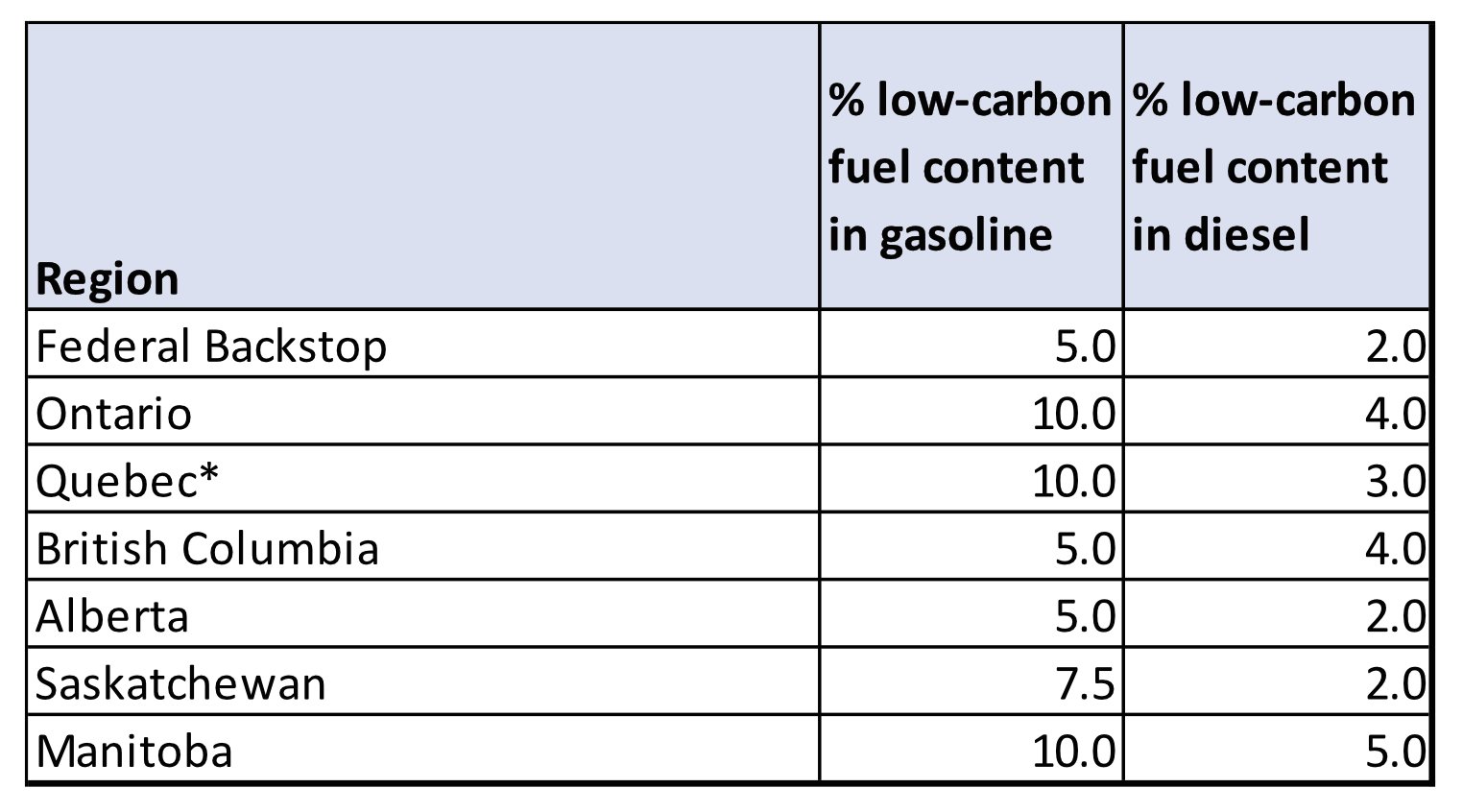

As of July 1, 2023, the CFR’s reduction requirements came into force when the Government of Canada published the final CFR. In addition to mandated fuel CI limits, Federal minimum renewable content in gasoline came in effect in December 2010 at five percent, and diesel in July 2011 at two percent.

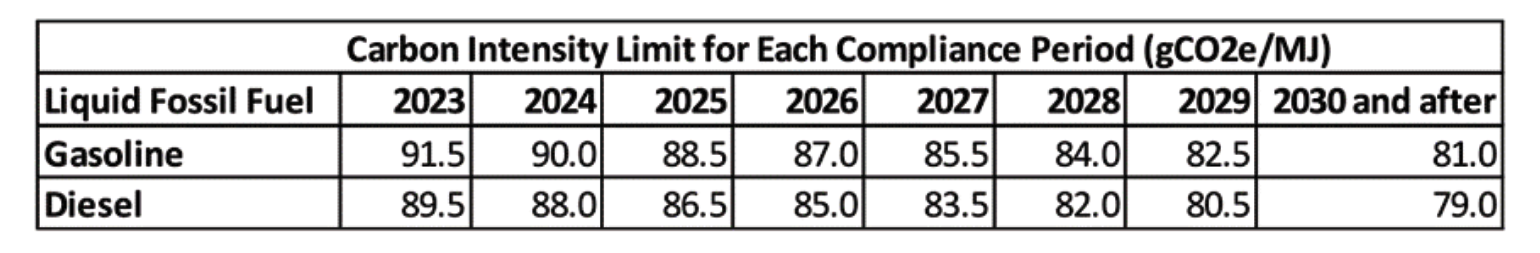

The CFR requires fossil gasoline and diesel primary suppliers (producers and importers) to reduce the CI of the fossil gasoline and diesel they supply to Canada annually.

Fuel Carbon-Intensity Limits

Source: ECCC, Clean Fuel Regulation

Canada allows for various provincial blending rates amidst a federal backstop for blend rates that remain in effect, below which provincial rates cannot fall as previously noted. These rates will be retained under the CFR. Provincial regulations vary, while Newfoundland, the Northwest Territories, and regions north of the 60-degree latitude are exempt.

2023 Low-Carbon Biofuel Content Mandates

* Note: Quebec mandate came into effect January 1, 2023

To meet the CFR’s annual CI reduction requirements, primary suppliers of fossil fuel must demonstrate compliance by either creating credits or buying carbon credits from other creators in Canada’s new carbon credit market. Each carbon credit represents fuel lifecycle emission reduction of one ton of carbon dioxide equivalent. The credit trading system does not have any interactions with other trading systems.

The Canadian government has stated that it will begin publishing carbon credit prices in the summer of 2023.

Clean Fuel Regulation

Most of the Land Use and Biodiversity (LUB) criteria that must be met by credit creators (feedstock growers) will go into effect in January 2024. The CFR has some unresolved eligibility and compliance details such as Canada’s producer declaration requirements.

U.S. producers of feedstocks and biofuels must register with the Minister of Environment to participate in the CFR.

In the case of feedstock certification, a feedstock is eligible for use under the CFR after harvesters, within their declarations, confirm that the feedstock meets the requirements of each LUB criterion, or state that their operation is obligated under a piece of legislation recognized by the CFR under the legislative (national or sub-national) recognition process.

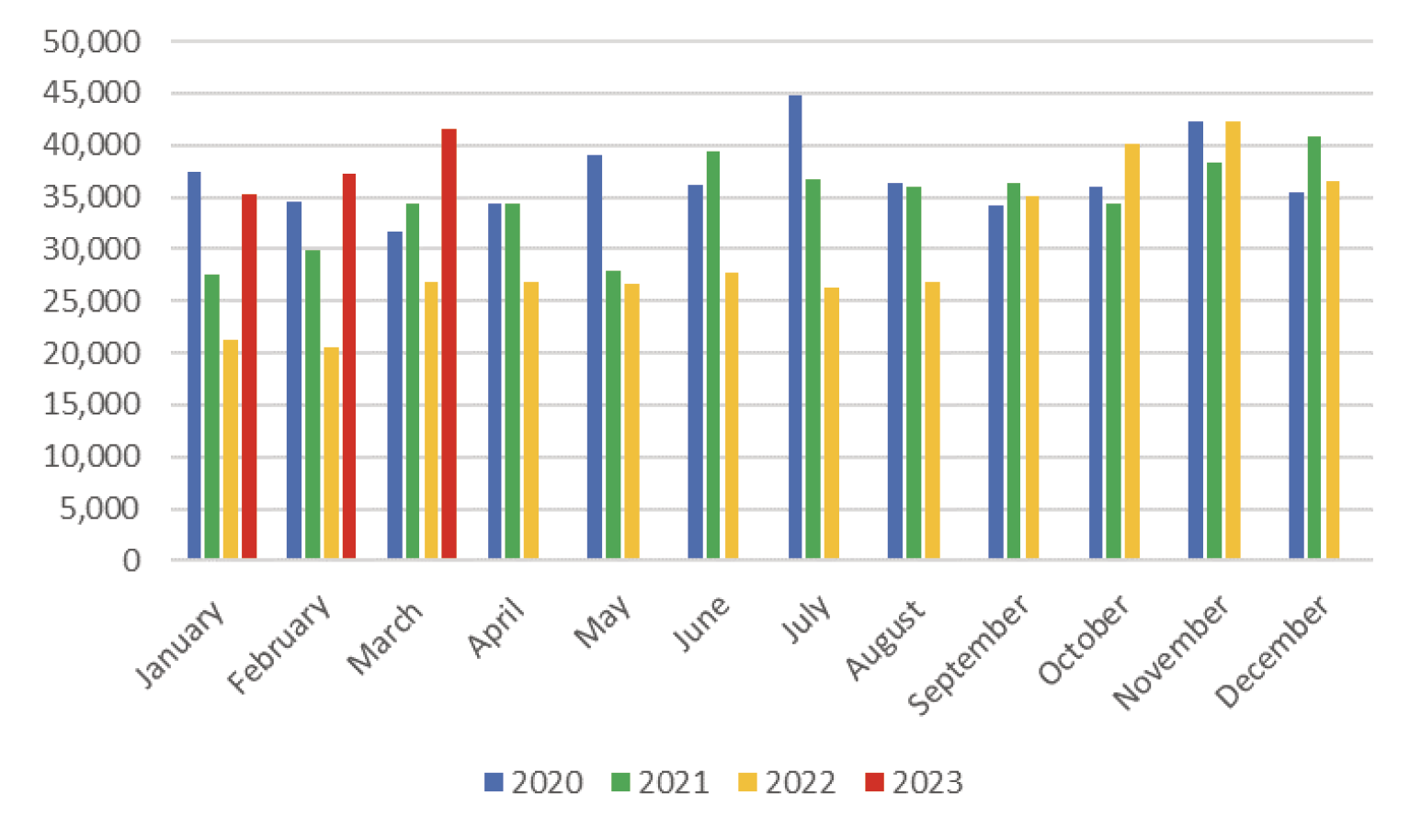

Biodiesel Production

Data source: Statistics Canada

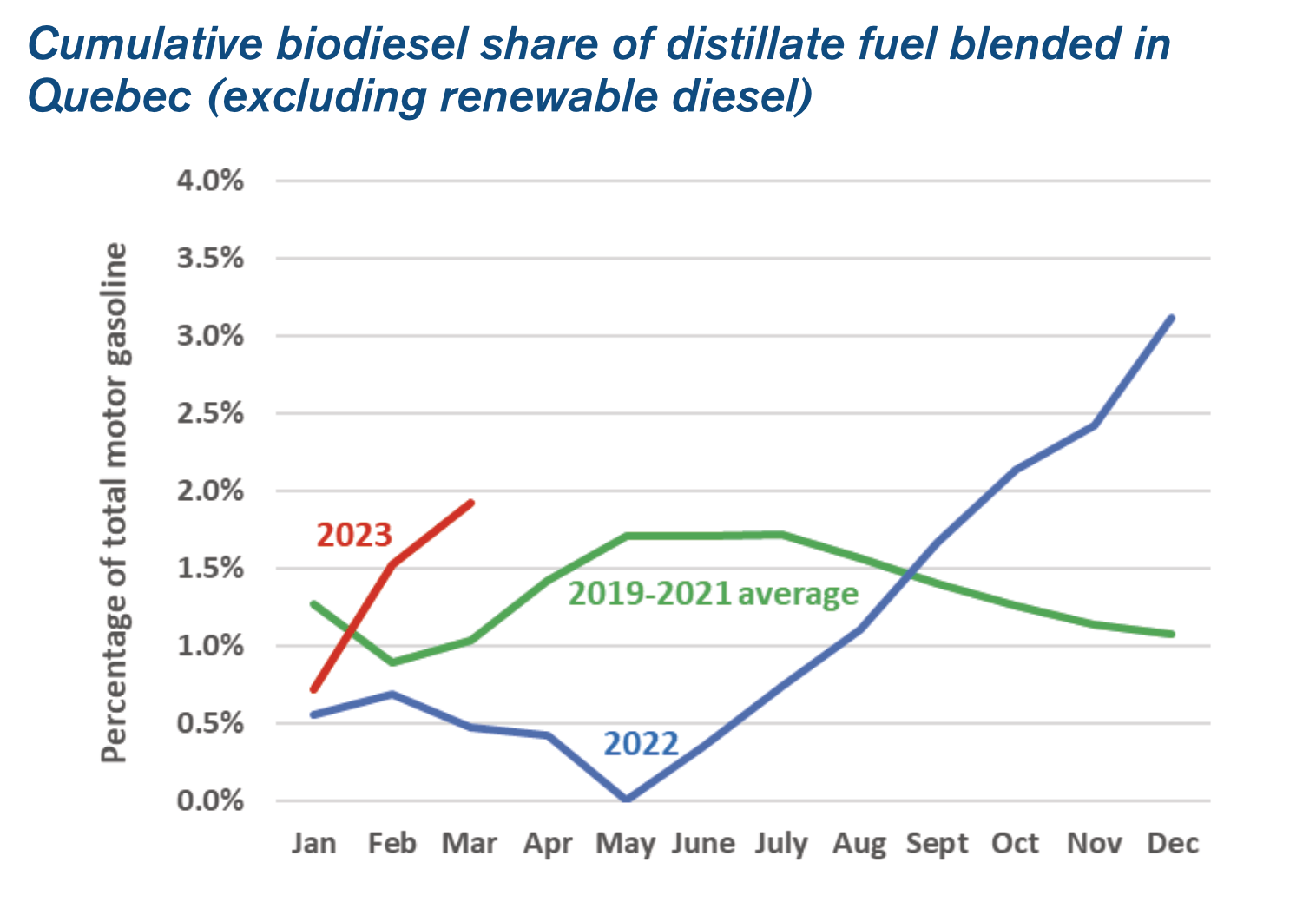

Data Source: Statistics Canada; forecast by FAS/Ottawa Note: Each month’s data reflects the annual biodiesel share of gasoline up to that point in the year; This data includes all diesel finished in the province, including exported diesel.

Data Source: Statistics Canada; forecast by FAS/Ottawa Note: Each month’s data reflects the annual biodiesel share of gasoline up to that point in the year; This data includes all diesel finished in the province, including exported diesel.

Biodiesel production fell 14 percent year-over-year to 357 million liters in 2022, but recovery to the 2021 level is expected in 2023. Canada is expected to produce renewable diesel (HDRD) for the first time in 2023.

Unlike in the United States, very little domestic yellow grease (UCO) and tallow is used as feedstocks for biodiesel production partly because supplies are tied to a much smaller population. At least two Canadian biodiesel producers located near the U.S. border import animal fat and yellow grease to meet nearly all their feedstock requirements.

There are 11 biodiesel facilities standing, with a capacity of 913 million liters, but only half are operational. Canola crush capacity is forecasted to grow from 11.3 million metric tons (MT) in 2022 to 16.5 million MT in 2025, according to a series of industry announcements. This growth is in conjunction with several announcements for new renewable diesel plants and expansions of established biodiesel facilities.

Competition for canola oil may increase after the U.S. Environmental Protection Agency finalized an action to approve Renewable Fuel Standard (RFS) pathways for HDRD that is produced from canola/rapeseed oil, in December 2022.

Related Posts

From Retailer to Representative: Chris Keyser’s Road to the Vermont State House

From Retailer to Representative: Chris Keyser’s Road to the Vermont State House

Posted on June 16, 2025

Northeast Working Group for Industry Principles Gets to Work

Northeast Working Group for Industry Principles Gets to Work

Posted on May 8, 2025

Trump Policies and Energy Markets

Trump Policies and Energy Markets

Posted on April 28, 2025

NEFI Introduces the National Home Comfort PAC

NEFI Introduces the National Home Comfort PAC

Posted on April 28, 2025

Enter your email to receive important news and article updates.