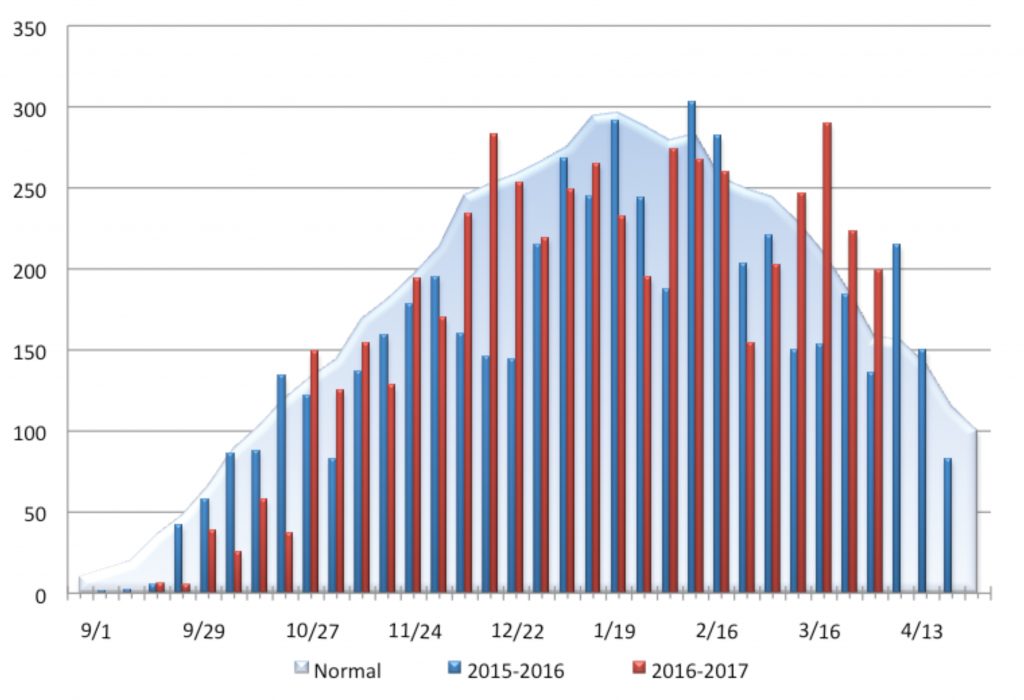

Every day counts in a highly seasonal business such as this, and some days count more than others. With the heating season recently behind us, and the relative lack of heating degree days (HDDs) that it brought, this is even more apparent and something to consider in upcoming seasons. NOAA’s Climate Prediction Center estimated a total of 5,188 heating degree days on an oil home heating customer-weighted basis in New England for the period of July 1, 2016 through April 1, 2017 (the latest report available as of this writing in early April). This was 634 HDDs (11%) below the 30-year average, but, thankfully, 323 HDDs (7%) more than for the same period last year. Figures were similar, but slightly more disappointing for the Middle Atlantic, with 4,452 cumulative HDDs. This was 766 HDDs (15%) below the 30-year average, but 256 HDDs (6%) above last year.

The bulk of the degree-days, which correlate strongly with consumption volumes, occur within a short time frame. From December 17 through March 18, NOAA estimates there were 3,106 HDDs in New England, which is 59.9% of the total as of April 1. Similarly, this period brought 2,828 HDDs to the Middle Atlantic, which is 63.5%. This means that the bulk of revenues are dependent on the margins you can capture during this short and critical period – and that stretching out periods of enhanced margin in these high-volume days could significantly impact profitability. One possible tool for doing so is short-term hedging.

Let’s consider a scenario where market prices are falling, and where you are able to lag this downward move with your retail price, resulting in an enhanced margin – say 3 cents per gallon (c/g) above target. It is late December or early January, where a single day can bring 35 degree-days, so it would be great if we could just hold on to this extra margin for a few more days. We could do this with short-term hedging by purchasing Call options or a combination of a bulk and Put options covering just the next few days. Let’s say today is Monday and the cost is 2c/g to purchase a Call option to cover the rest of the week – this would leave us with an extra penny in margin net premium in a critical time.

How would one decide between a Call option strategy versus a Put and bulk strategy? The key here is one’s view on basis. Let’s look at each. Call options protect the buyer against rising market prices, which compensate for higher prices when you pick up at the rack, but also allow you to enjoy the downside as you do not need to exercise the option if prices fall below your strike price but you can still pick up at cheaper prices at the terminal. However, prices at the rack need not move in lock-step with the NYMEX futures prices – this is the basis risk. If rack basis strengthens between when the Call option is purchased and when pickups are made, this will adversely impact margins. The Call option will compensate you for any increase in the market price, but not for any increase in the spread between the rack price and the market price. Conversely, if basis weakens, there is a benefit to be had – in short, a paper-only strategy is short basis. Accordingly, this may make more sense during times where there are reasons to believe the risk of a basis blowout is lower or, ideally, that basis is set to weaken. Strong storage levels and being in the first half of the heating season could be factors in making this decision.

If we think basis has a higher chance of spiking – say, if storage levels are low and meteorologists predict an extended cold snap – it may make more sense to look at a short-term hedge involving a bulk purchase with a Put option. This is because a bulk purchase means basis is fixed – the spread between the physical price and the market price is fixed. The Put option gives the buyer the right to sell at the strike price, providing protection against falling prices. Should prices rise, the bulk price is fixed and you simply do not exercise the Put option. Hopefully, next year will bring more degree-days and more delivered volumes and associated revenues. This would also mean that each day you can hang on to strong margins would have an even greater impact on profitability for the season. Keep short-term hedges in mind next season as one tool in your margin management toolkit.

The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.