How energy marketers can plan for threats, both immediate and long-term

The recently published results of our 29th annual Energy Industry Survey contain a wealth of valuable information for fuel oil and propane marketers who understand that analyzing their numbers can create the best way to move forward. Although the data collected must now be viewed in the shadow of COVID-19, there is much that can be learned and applied to help you advance your energy business in the face of today’s unprecedented challenges.

If there is a lesson business leaders can draw from the COVID-19 calamity, it is the need to develop a more resilient organization. Nobody could have foreseen the devastating global economic impact that has been caused by a microscopic virus. Yet there are many other challenges that could play havoc with your business unless you are prepared. Unfortunately, some of the responses found in the 2020 Energy Industry Survey suggest that not all fuel dealers have plans in place to respond to a crisis of even limited proportion.

A resilient organization is one that takes steps to identify and prevent foreseeable problems, but also puts concrete plans in place to manage and recover from disasters that cannot be anticipated or avoided. Some threats are clear, obvious and immediate. Other threats are more existential and long-term, challenging not only individual businesses but the energy industry as a whole.

Immediate Threats

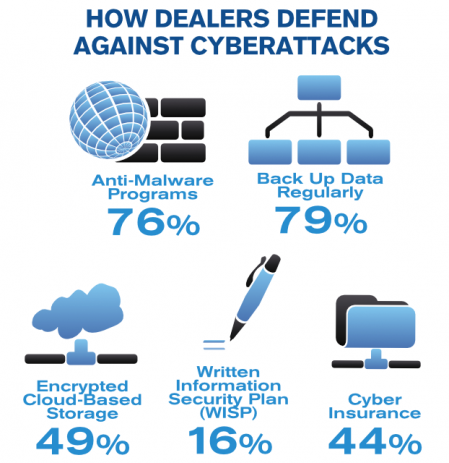

One example of an immediate problem is cybersecurity. Cyberattacks on businesses of all sizes are accelerating at an incredible rate, with ransomware attacks alone quadrupling from 2018 to 2019 (according to the Trustwave Security Pressures Report). Yet responses from energy marketers in our 2020 survey about how they were defending their companies from cyberattack demonstrate a lack of urgency.

Most dealers have installed anti-malware programs (76 percent) and back up their data regularly (79 percent). But less than half (49 percent) use encrypted cloud-based data storage, which is the most secure way to protect data. And a paltry 16 percent have a written information security plan (WISP), despite the fact that it is required by law in many states. Let’s hope the companies without a WISP in place are among those investing in cyber insurance (44 percent).

Not convinced that your company is large enough to come under attack? Statistics show that 40 percent of organizations that fall victim to data breaches are small businesses – half of which fail within six months of an attack.

It is incumbent upon businesses of all sizes to take cybersecurity seriously. We have been conducting security assessments for an increasing number of clients in the past few years. It starts with a comprehensive audit of your security practices, followed by the development and implementation of up-to-date defense methods, including secure cloud data storage, robust anti-malware and anti-ransomware barriers, and required staff training. All of this should be recorded in a WISP so that, should a data breach occur, you can demonstrate to regulators that you had taken the necessary steps.

Rebounding from a Financial Crisis

Few industries are immune to the crushing financial impact of the COVID-19 crisis. However, the energy business may have evaded a more damaging blow due to fortuitous timing. The national shutdown, occurring in mid-March, came at the tail end of the heating season; while the economy in most states is once again starting to open up now, just in time for the start of winter. As a result, many fuel oil and propane dealers were able to get through the downturn relatively unscathed.

This is reflected in answers to our Energy Survey questions related to COVID-19. Relatively few dealers needed to downsize their workforce through layoffs (15 percent) or furloughs (19 percent). Almost half reported they reduced employee hours but maintained their regular pay rates (47 percent). Encouraging, but will this be possible if a second pandemic wave rolls over the country this fall? It may be difficult to operate on reduced hours when fuel deliveries start ramping up.

Part of the reason so many energy marketers were able to retain workers and ride out the economic downturn was the fact that the last two heating seasons have been profitable. That left dealers in a good cash position, an important advantage when the economy gets tight. Which leads to another important characteristic of a resilient company – financial stability.

When things are going well, there is a natural tendency to think things will always go well. A cold winter, low fuel prices, and a stable supply of product over the past several years have put many energy dealers into an agreeable financial position. What you do with your profits is an indication of whether or not you are building a resilient business, one that will be able to continue to operate should things not go so well.

This is where it is important to have a strategic financial plan in place, both for your business and (for privately held companies) for yourself. You need to be deliberate and intentional in setting up financial controls, investing wisely in the company, and making financial decisions based on accurate and timely information. A strategic plan will help you use available finances and other capital resources to achieve your goals while also preparing for unexpected setbacks.

An Industry at Risk

Other issues that need to be addressed by a resilient company are more universal. The very products we market are under attack. The growing public attitude against fossil fuels may be misguided, but it is very real and finding support in elected leaders who are quick to take political advantage of public sentiment.

A huge volley was fired by the Massachusetts Senate in January when they passed a bill calling for statewide “net zero” emissions by 2050. Their legislation includes a carbon-pricing mechanism that would place a fee on fossil fuel use, including fuel oil, propane, natural gas, diesel and gasoline. This action is aimed directly at the petroleum and gas industry and favors alternative energy sources like solar and wind, with a stated purpose of transitioning to carbon-free electric power over the next 30 years.

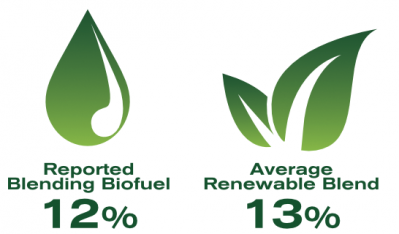

To be ahead of the curve, energy marketers must be innovative and willing to change course. Our trade associations are leading the way. NEFI’s recent commitment to 15 percent carbon reductions by 2023, 40 percent reductions by 2030 and net-zero by 2050 sets ambitious goals. They will require a blend of 20 percent biofuel by 2023, 50 percent by 2030, and 100 percent renewable fuel by 2050.

The problem is that only 12 percent of energy dealers responding to our annual Energy Survey report blending biofuel, and the average blend is only 13 percent renewable. That might seem a steep mountain to climb if we are to meet the self-imposed goals on schedule. But committing to making a shift in product is a sign of a resilient business. So is making other accommodations and adjustments to meet a changing marketplace.

For many years we have promoted the benefits of diversification for energy companies. For the most part, the focus has been on adding more — but similar — products and services, such as propane delivery. However, market evolution is accelerating, and you need to look at your business in a different light. To survive, you will have to expand your horizons out of your “comfort zone” into a broader spectrum of goods and services.

Think about your most valuable corporate asset, your customer list. The relationship you have built with your customers is a critical link. They trust you to deliver comfort and security. What else can you do for them? How can you further strengthen the bond?

This goes back to strategic planning – exploring resources that can be intelligently applied for future growth. It may be time to examine additional home services that are not directly energy related but can be provided based on that trusted relationship with your customers. Or time for adapting how you work with customers by improving technology to facilitate ordering, payment and communications.

Once you have a strategic plan in place, share it with your employees, lenders, suppliers and customers. They should all know that you are prepared to weather almost any storm.

Resilient businesses anticipate, adjust and adapt. They do not “wait it out” and hope for the best, but instead take charge of creating their own best outcomes. They invest time, money and commitment to develop a plan of action that outlines the path forward, while they remain flexible enough to respond quickly to problems and take advantage of opportunities.

Are you ready to be resilient?

Joe Ciccarello and Marty Kirshner are members of the Energy Practice Group at business advisory and accounting firm Gray, Gray & Gray, LLP. Learn more at gggcpas.com.