Their differences make one right for you

The heating oil industry in the Northeast has set goals to reduce greenhouse gas (GHG) emissions to zero by the year 2050. Biodiesel has been a large part of the conversation since the Providence Resolution was adopted at the Northeast Industry Summit in September of 2019, nearly five years ago. However, biodiesel is not the only game in town when it comes to reducing GHG emissions. There is an increasingly popular alternative: renewable diesel.

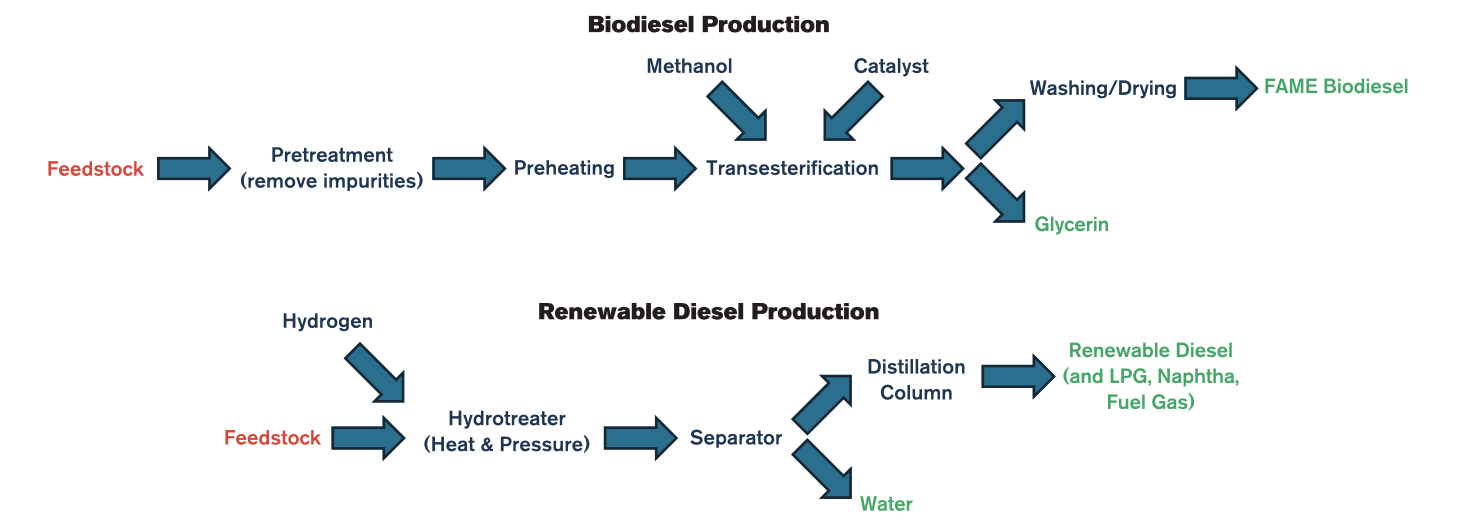

Biodiesel and renewable diesel might sound like they ought to be the same thing, but they are significantly different - both in how they are produced and in their actual specifications. Both are bio-mass-based diesel fuels, using feedstocks such as vegetable oil (often soybean oil) or animal fat. This is not a new idea, as even Rudolf Diesel, who invented the diesel engine in 1897, experimented with using vegetable oil. The difference between the two fuels lies in the production process. Biodiesel is produced through a process called transesterification, where a chemical reaction between the feedstock and an alcohol such as methanol is started with a catalyst such as lye. This produces both glycerin, as a byproduct, and fatty acid methyl esters (FAME) a.k.a. biodiesel. Renewable diesel is typically made through a process called hydrotreating, a process which is also used to “crack” the long hydrocarbon chains found in crude oil into gasoline and distillates. This works by introducing the feedstock to hydrogen in a hydrotreating reactor, over a bed of solid, particulate catalyst at high temperature and high pressure. Steam and light gases are then separated, and the resulting hydrogenated liquid hydrocarbons are distilled by columns into various products including renewable LPG, naphtha, and diesel. Because this is an existing process at many crude oil refineries, many have been converted to renewable diesel production. On the other hand, the construction of new units would be much more expensive than building out biodiesel production capacity.

How are we reducing emissions, exactly? Compared to conventional diesel production, where hydrocarbons are pulled out from the earth, broken into usable chains, and then subject to combustion and the release of previously sequestered carbon into the atmosphere, biodiesel produces fewer emissions. In the case of soybean oil, the plants pull carbon out of the atmosphere, which is then re-released when the final product is combusted. Of course, there are many energy inputs along the way, so the net result is something like a 74% reduction in lifecycle emissions for 100% biodiesel (B100), per the Department of Energy.

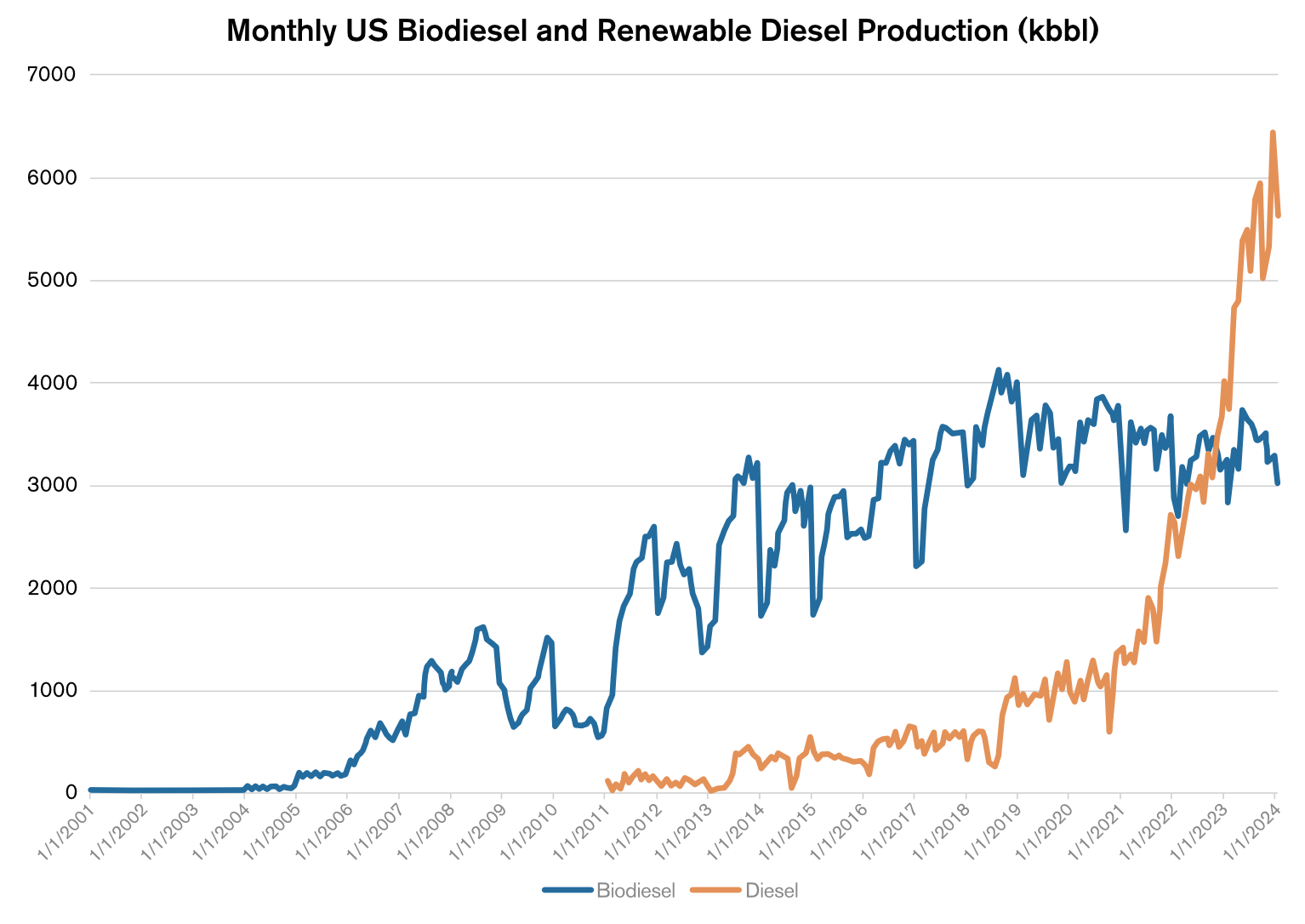

While manufacturers have introduced burners and heating systems that are certified for up to 100% biodiesel (B100), a key difference between biodiesel and renewable diesel is that the former is not a drop-in solution for existing equipment. Most OEMS recommend blending to 20% (B20) or less, for which Neste calculates a GHG emission reduction rate of 15%. By contrast, as renewable diesel meets ASTM D975, it can be seamlessly used as a drop-in fuel, transported in pipelines, and sold at retail stations. Neste calculates that this leads to up to a 75% reduction in GHG emissions over petroleum diesel. Other notable differences between ASTM D6751, which biodiesel meets, and ASTM D975 (or ASTM D396 for renewable heating oil) are a higher cetane (combustion efficiency) number, increased fuel stability, and cold weather performance, according to Neste. Per EIA data, monthly biodiesel production peaked at 4.1kb/d in August of 2018 and has fallen to 3.03kb/d as of January of this year. Meanwhile, renewable diesel production shot up from near zero in early 2011 to surpass biodiesel by November of 2022 and on to a recent high of 6.42kb/d in December of last year.

Bio-mass based diesel is more expensive to produce than petroleum diesel, as the combined cost of feedstocks plus processing, either through transesterification for biodiesel or via hydrotreating for renewable diesel is higher. This means that production is currently only economically viable due to regulatory incentives, namely Renewable Identification Number (RIN) credits and the Blender’s Tax Credit (BTC) at the federal level, as well as some state-level programs. The BTC provides qualified producers or blenders with a $1.00 income tax credit per gallon of B100 or renewable diesel, but the total amount of credits is capped at $10m per year (10 million gallons). In addition to this economic incentive, RINs are tradable credits that can be purchased to help an obligated party (importers, blenders, and fuel refiners) meet renewable volume obligation (RVO) levels set under the Renewable Fuels Standard (RFS), which sets a minimum amount of renewable transportation fuels sold in the US. In 2023, biodiesel production capacity was estimated at over 2 billion gallons and renewable diesel capacity was over 3 billion gallons. Environmental Protection Agency data showed that by September of 2023, annual production had exceeded the 2.82 billion gallon D4 mandate. Making matters worse for RIN prices, much of the increase in production has been in renewable diesel and, according to S&P Global Commodity Insights, each gallon of renewable diesel that is blended generates 1.70 biomass-based diesel (D4) RINs, compared to 1.50 D4 RINS for biodiesel. Along with pressure from the soybean oil – heating oil (BO-HO) spread, we have seen D4 RIN prices tumble down from nearly $2.00/RIN in late November of 2022 to under $0.40/RIN in February of this year. Some relief for domestic producers may come next year when the BTC is set to be replaced by the Clean Fuel Production Tax Credit (PTC), which will make domestic production more competitive against imports. Currently, importers can receive the BTC, but will not be eligible for the PTC.

At the state level, Low Carbon Fuel Standard (LCFS) programs in California, Oregon, and Washington allow refiners to generate credits for producing fuels that have a lower carbon intensity than in requirements set by the state. These subsidies have been effective, pushing renewable diesel up from nearly 0% of the California diesel market in 2012 up to about 50% of the market as of last year, and market share is rising in both Oregon and Washington as well. Looking forward, a number of other states are looking at possible LCFS programs. Programs have been discussed in Massachusetts and in Pennsylvania, and studied in New York. Looking at heating specifically, we will want to keep a close eye on Clean Heat Standard (CHS) programs such as those drafted by the Massachusetts Department of Environmental Protection. This draft program would include both biodiesel and renewable diesel as options for CHS compliance. For now, however, renewables represent a very small share of diesel production despite the rapid growth. Combined US bio-diesel (0.10mb/d) and renewable diesel (0.19mb/d) production of 0.29mb/d this January remains a far cry from the 4.61mb/d of petroleum distillate produced the same month.

Dan Lothrop is Head Trader at over-the-counter derivatives company Northland Energy Trading LLC. He can be reached at 800-709-2949 or daniel@hedgesolutions.com.

The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.