All

Basis Blowout Ahead?

by Dan Lothrop, Northland Energy Trading

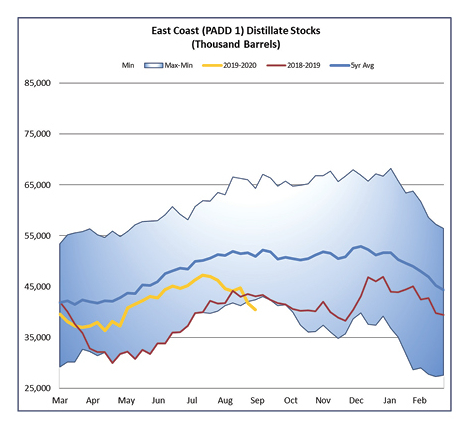

This year’s East Coast distillate stock building season seemed to be going well enough from early June through early August. East Coast stock levels were at a deficit to the five-year average, but a relatively small one compared to the surplus they enjoyed over last year’s levels. Stockpiles then took a counter-seasonal turn as two major factors impacted both sides of the supply-demand equation in August.

First, the 335 kb/d Philadelphia Energy Solutions refinery was hit by a fire and explosions on June 21. An alkylation unit on the 200kb/d Girard Point section of the refinery was destroyed. The company decided to permanently shut down operations in late June and filed for Chapter 11 bankruptcy in July – its second time in two years. As of August 1, Genscape reported that all monitored units at the refinery were offline. Second, U.S. distillate exports jumped from relatively low levels during the July 19 reporting week to average 1.51 mb/d in the month of August – well above the 1.13 mb/d average seen during the same period last year. East Coast distillate inventory levels tumbled 14.4% lower, from 47.24 mb on August 9 to 40.43 mb as of September 27.

These relatively weak stock levels, combined with the loss of local PADD 1 production from the PES refinery, indicate a higher likelihood that we could see a basis blowout this winter. In times of stress to the system, such as a period of strong demand due to cold temperatures, or supply problems, inventory levels provide a cushion – there is available supply to meet demand during the crunch. As levels are at five-year lows for this time of the year, that cushion is not very strong. Additionally, although year-on-year refinery runs look relatively flat as of the time of this writing, this is because we are near the height of fall maintenance operations, masking the loss of PES production, which will likely make itself seen in the coming reporting weeks (barring a very unlikely restart of production at the undamaged section of the refinery).

Visualizing Basis Risks

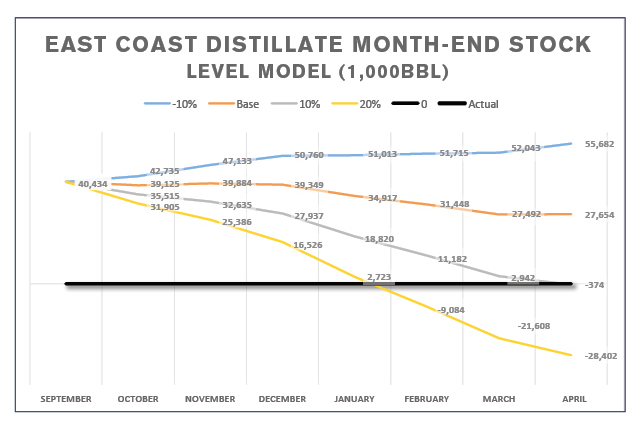

Here at Hedge Solutions, we provide a simple yet illustrative model of East Coast distillate stock levels to help us, and our clients, visualize basis risks. Each year, we update five-year averages for PADD 1 production, maritime imports, inter-PADD transfers and implied demand. We then use late September stock levels as a starting point and stress the model by pushing implied demand up and down, simulating a warmer or colder than baseline winter.

This year, we subtracted the lost PES output – which we estimate at just over 100 kb/d, based on a 3:2:1 crack and applying the five-year average trend in PADD 1 refining activity for the October-April period (monthly weights). Additionally, we added 40 kb/d to the model from the partial reversal of the Laurel pipeline.

As shown in the static stock level model, we can see that inventories could fall dangerously low if implied demand exceeds the base case. It should be noted that this is a static model, meaning that prices will react to supply and demand and thereby redirect the path inventories take. What it does do is highlight whether or not we should be paying more or less attention to basis risks for the upcoming season.

Considering Demand Questions

What are we likely to see on the demand side? The temperature outlook so far is an unsupportive factor for basis risks, as the September 19 issues of October-December and November-January temperature probability maps from NOAA’s Climate Prediction Center saw higher chances for above-normal temperatures across the country.

On the other hand, IMO 2020 regulations come into force on January 1. This is a global issue, so one should be careful not to overestimate the impact on the U.S. East Coast market. On the margin, however, it is a supportive factor, as many ship-owners appear likely to purchase low-sulfur Marine Gasoil, a middle distillate, in order to comply with the regulations. While it is more expensive than (the much heavier) Very Low Sulfur Fuel Oil, it is also an established fuel, available and relatively free of the quality concerns that some may have about novel LSFO blends. The extent to which ship operators favor one or the other will determine how much competition for the diesel/jet/kerosene portion of the distillation column there will be.

While the risks may not materialize, there appear to be stronger chances that we could see basis blowout this winter. Accordingly, long basis positions such as fixed differentials, prompts, and/or wet barrel contracts deserve a look. Account executives at Hedge Solutions have years of experience and market knowledge with which to advise clients on these matters, and other means of protecting and improving fuel margins.

The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.

Related Posts

2025 Hedging Survey

2025 Hedging Survey

Posted on April 29, 2025

Trump Policies and Energy Markets

Trump Policies and Energy Markets

Posted on April 28, 2025

Hedging Strategies for Next Winter

Hedging Strategies for Next Winter

Posted on March 10, 2025

A Volatile Start to the 2024-2025 Heating Season

A Volatile Start to the 2024-2025 Heating Season

Posted on December 9, 2024

Enter your email to receive important news and article updates.