All

Basis as the Basis for Smart Hedge Strategies

by Rich Larkin, Hedge Solutions

Knee-jerk reactions to every crisis are bound to lead to buyer’s remorse

I’ve become wary of making the last year’s crisis the prime focus for dealing with or predicting next year’s issues. This is because no matter what is predicted, it rarely comes to be. You can review history back to the origins of the energy commodity (it’s only 44 years) and find this is the case the majority of the time. More recently I would point to 2008, 2015, 2018, 2020 and 2022.

A quick summary (see Illustration 1)

2008: Oil prices trade to $4.15. “We’re running out of oil, literally!” Prices crash to 5-year low.

2015: Shale boom goes into full bloom. Prices retreat to 13-year low.

2018: Khashoggi murder/IMO horizon spike prices pre-season (October). Prices drop .84 cents by December.

2020: IMO fears drive prices .50 higher by end of 2019. Covid arrives. Prices drop to 18-year low over the winter.

2022: Russian invasion of Ukraine spikes prices to an all-time record of $5.8595 on April 29. Oil price proceeds to drop $3.58 to $2.58 over the following heating season (this year).

Looking back at market sentiment, most of these price shocks endured the typical commodity panic cycle of “the fear of not enough” to “the fear of too much.”

The primary reason for pointing out the typical yet errant proclivity to knee-jerk your strategy based on the most recent event is as a warning to steer away from bad habits and stick to what has stood the test of time: a conservative, well-balanced hedging strategy based on profit margins and mitigating your risk to those margins.

One of the most critical components in that strategy, which has gotten scant attention until this year, is the basis. However, like the attention to price movements over the years, basis has suddenly moved to the front of the class, thanks to the previous season’s record-setting levels and the disruption it caused to the hedge programs. Basis, often ignored or discounted until this year, is simply the difference between the ULSD futures contract that we all use as a proxy for COGS and the actual physical price of oil at our supplier’s rack, or as they say, “where the real money is made.” At the end of the day, you must put the oil in the truck and transport it to your customers. Hence, basis matters.

So, as we look to next year and since this is the Oil & Energy Magazine annual hedging survey issue, I will focus on preparing for the hedging plan for next season, with a particular focus on basis risk.

Most importantly to note here is that basis “risk” absolutely pivots both ways. One only needs to have experienced – or know of somebody who has experienced – the buyer’s remorse over the basis deals this year that ran anywhere from as low as .25 and up to .60 over NYMEX for a so-called supply contract. Then December came around and the oil rolled into PADD 1 (primarily New York Harbor) and the rack differentials normalized. That meant you could buy oil at even or under the NYMEX, leaving the basis contracts at a significant premium to what everyone else was paying. Still, what October and November was sustained or higher going into the heating season? What if there were no spot rack sales available some weeks?

Unfortunately, these questions are unlikely to go away. Currently, the wet barrel differentials when quoted against the actual forward heat curve for next heating season are at near or plus .20/gallon. Most hedgers do not understand this dynamic. You cannot cover the downside risk in basis once you’ve locked it in. In other words, the put option that covers you from the NYMEX price falling will not cover the basis if you lock in .20 over and the rack goes to minus .10. Your costs will come in .30 higher than the rack in this case. Additionally, if it’s a warmer than normal winter as was the case this year, you have the added problem of moving the contract oil that you committed to.

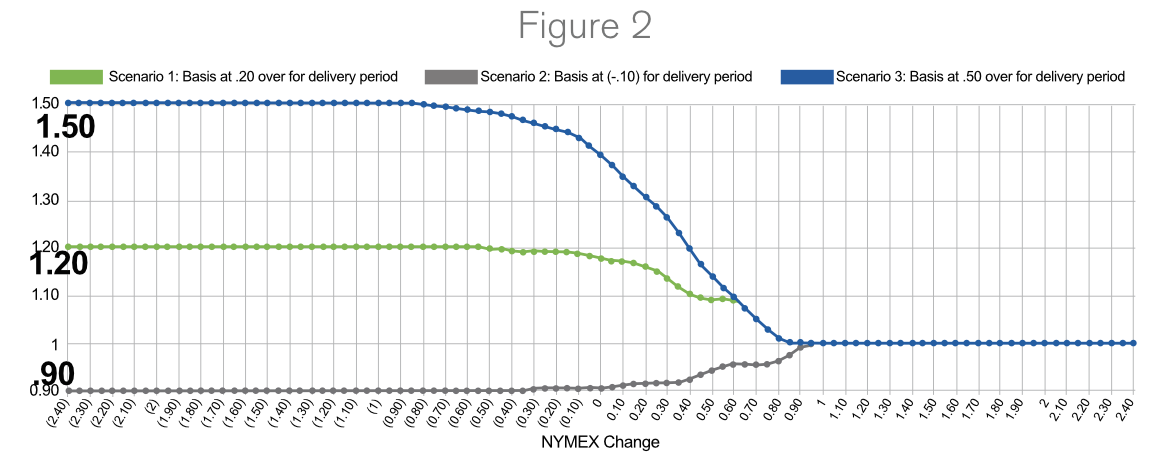

I’ve given an example below (see Illustration 2). The graph below charts three potential scenarios in hedging a cap program. All three scenarios incorporate buying wet barrels at .20 over the NYMEX and hedging with put options. Scenario 1 displays the margin per gallon if the rack basis is .20 over NYMEX during the delivery season. Scenario 2 displays the margin per gallon if the rack basis is -.10 under NYMEX during the delivery season. Finally, Scenario 3 displays the margin per gallon if rack basis is .50 over NYMEX during the delivery season. As you can see, the results between each scenario in a down market is .30 per gallon between each of the strategies. This is intentionally simplistic to make a very distinct point. The resulting margin in each strategy is a minimum of a .30 per gallon difference, depending on where the rack basis ended up during the delivery period. Additionally, and significantly, the difference between rack basis going negative and rack basis going positive at .50 over is a whopping .60 per gallon spread between the worst case scenario at .90 and best case at .50 per gallon.

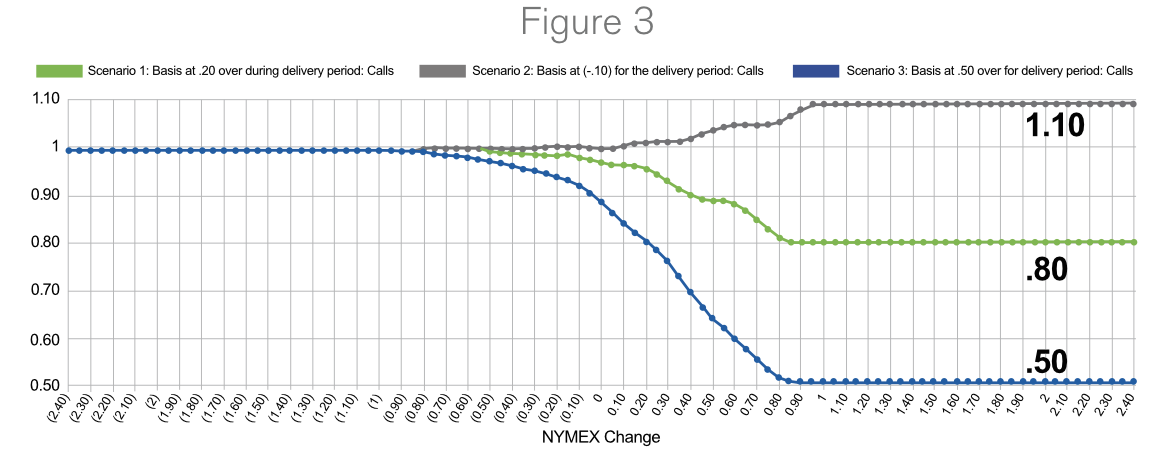

Now let’s look at the same hedge with call options instead of the wet barrels and puts (see illustration 3). As you can see, the call strategy profit margin scenario is virtually the same as the put options, except the chart is flipped as the basis issue is causing margin deterioration if prices go up rather than down.

Is there a perfect hedge? The answer is no. You simply can’t control every variable, including the weather. A balanced approach is best, including how you go about managing basis risk. There are also a variety of strategies available to cover basis risk besides just buying wet barrels. Getting the right mix requires a bit of due diligence, but it’s worth the effort since the margin outcome can vary significantly.

Rich Larkin is President of risk management consultancy Hedge Solutions. He can be reached at rlarkin@hedgesolutions.com or 800-709-2949. www.hedgesolutions.com

The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.

Related Posts

2025 Hedging Survey

2025 Hedging Survey

Posted on April 29, 2025

Trump Policies and Energy Markets

Trump Policies and Energy Markets

Posted on April 28, 2025

Hedging Strategies for Next Winter

Hedging Strategies for Next Winter

Posted on March 10, 2025

A Volatile Start to the 2024-2025 Heating Season

A Volatile Start to the 2024-2025 Heating Season

Posted on December 9, 2024

Enter your email to receive important news and article updates.