Businesses should consider implementing hedging strategies ahead of the heating season to help protect against sharp moves in ULSD prices.

As we approach the 2025/2026 winter season, there are many signs suggesting that the US diesel market may be heading toward a serious supply crunch. With refining capacity under pressure, inventories at historically low levels, and exports remaining elevated, concerns are mounting that the US could face a diesel shortage just as demand for heating and transportation begins to rise.

US refining capacity has been on a decline over the past five years, with the most recent setback being from the closure of LyondellBasell’s 268,000 barrels per day (b/d) Houston refinery. According to the Energy Information Administration (EIA), total operable refining capacity fell from 19.0 million b/d (mb/d) at the start of 2020 to 18.1 mb/d as of April 2025 – a decrease of nearly five percent. The loss of complex refining units has disproportionately impacted US diesel production. Gulf Coast refiners, once major exporters to Europe and Latin America, face operational constraints and growing political pressure to prioritize domestic supply. Moreover, seasonal maintenance and unplanned outages have further reduced output during the summer. As a result, despite refinery utilization being near 97 percent, distillate inventories remain critically low and have failed to recover heading into second half of the year.

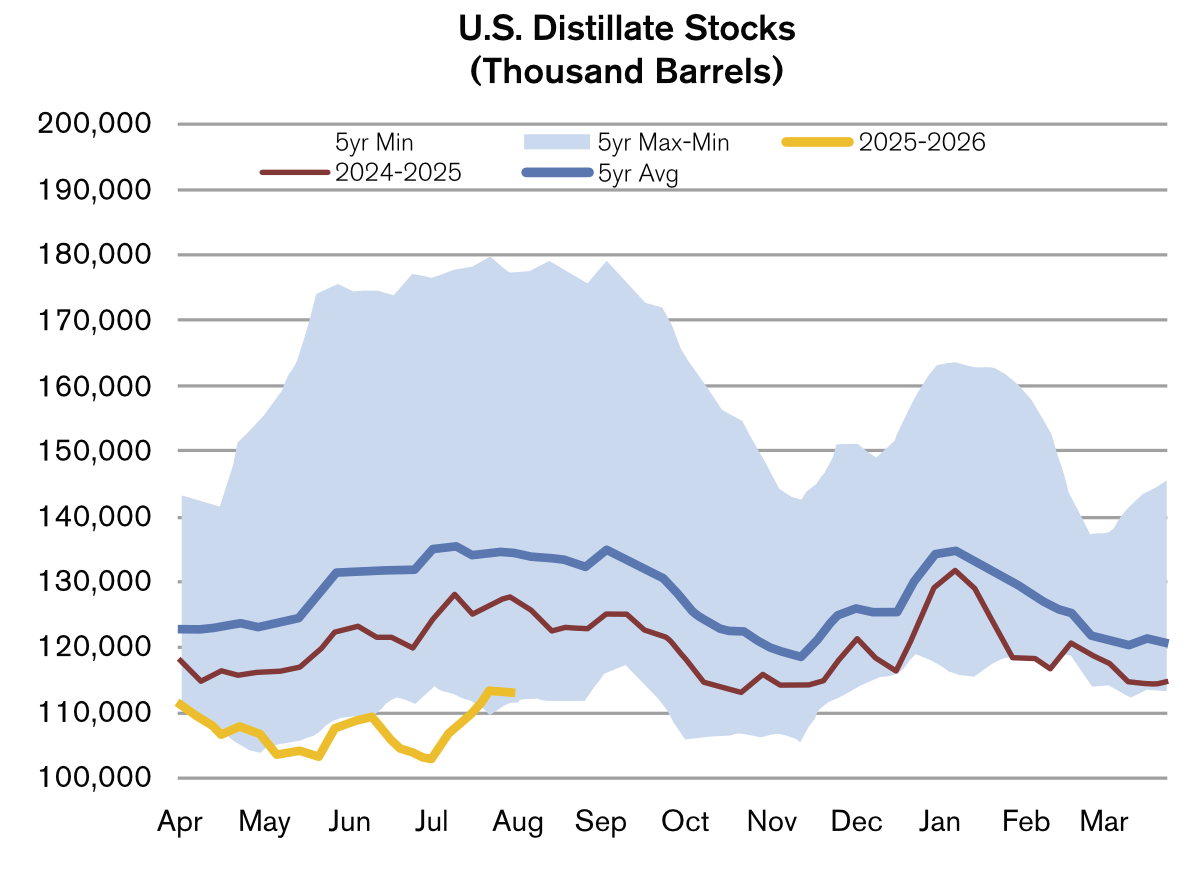

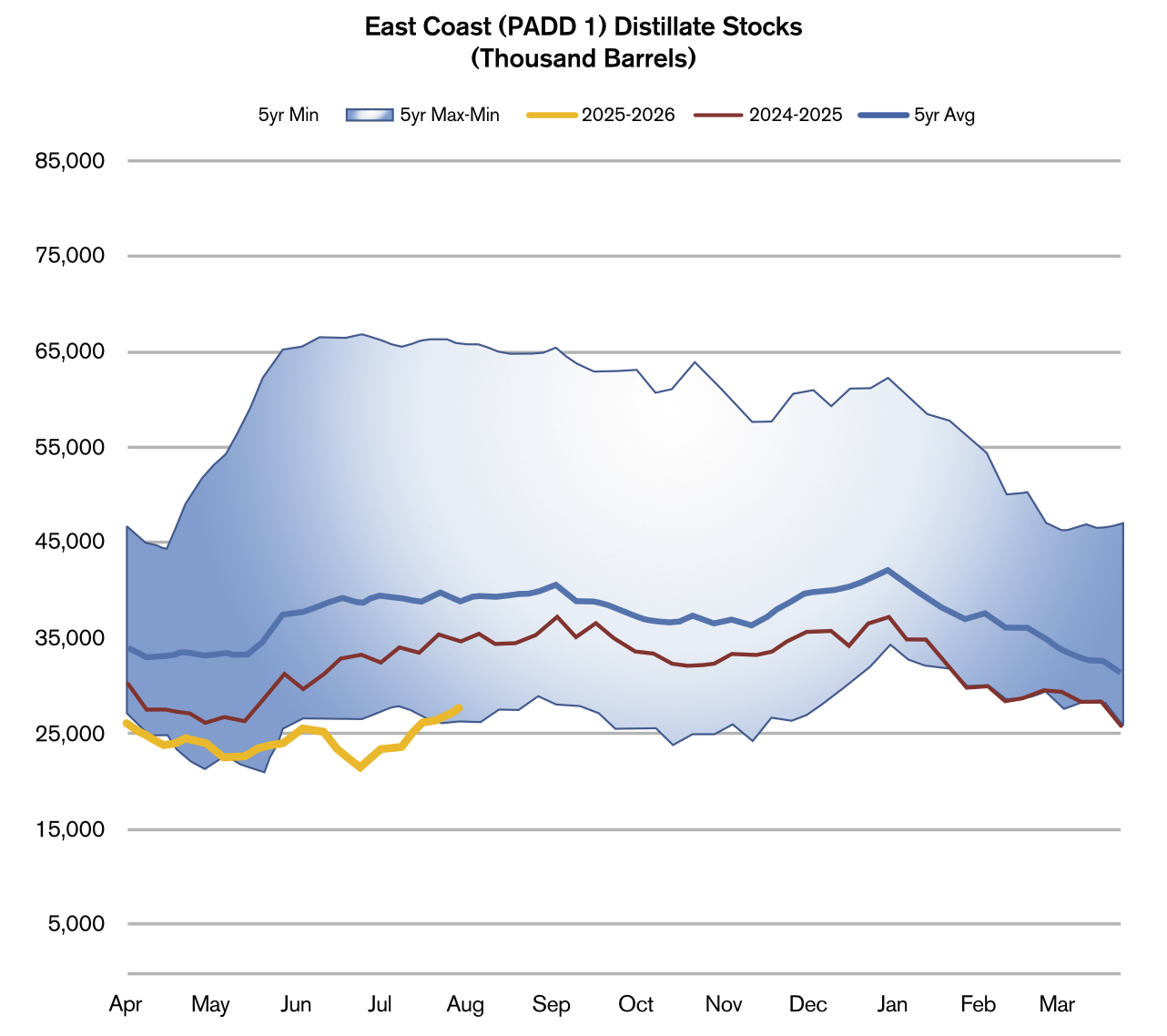

As of early August, U.S. distillate fuel oil inventories were 16.1 percent below the five-year average and 11.6 percent lower than a year ago, according to the EIA. In early July, distillate inventories hit their lowest levels since the post-COVID crunch in 2022 but have since recovered slightly. However, this time the situation is different – the Strategic Petroleum Reserve is significantly depleted, and the refining system has even less flexibility to respond to disruptions. If current trends continue, the EIA projects that distillate stockpiles could fall to their lowest pre-winter levels since 2000. The situation is worse in the East Coast (PADD 1) region, where inventories are down 20.8 percent year-over-year and 29.4 percent below normal.

Despite tight domestic supply, US diesel exports remain elevated. Most of the Gulf Coast diesel exports go to Latin America due to refining shortfalls. Balancing the need to support key trade partners while protecting domestic supply has created a policy and logistical challenge. Although no export restrictions have been imposed so far, some market analysts are warning that Washington could face pressure to limit diesel exports if the market tightens further. As of the week ending August 1, US distillate exports averaged 1.55mb/d, roughly in line with the same week last year but 14 percent higher than the five-year average, according to the EIA.

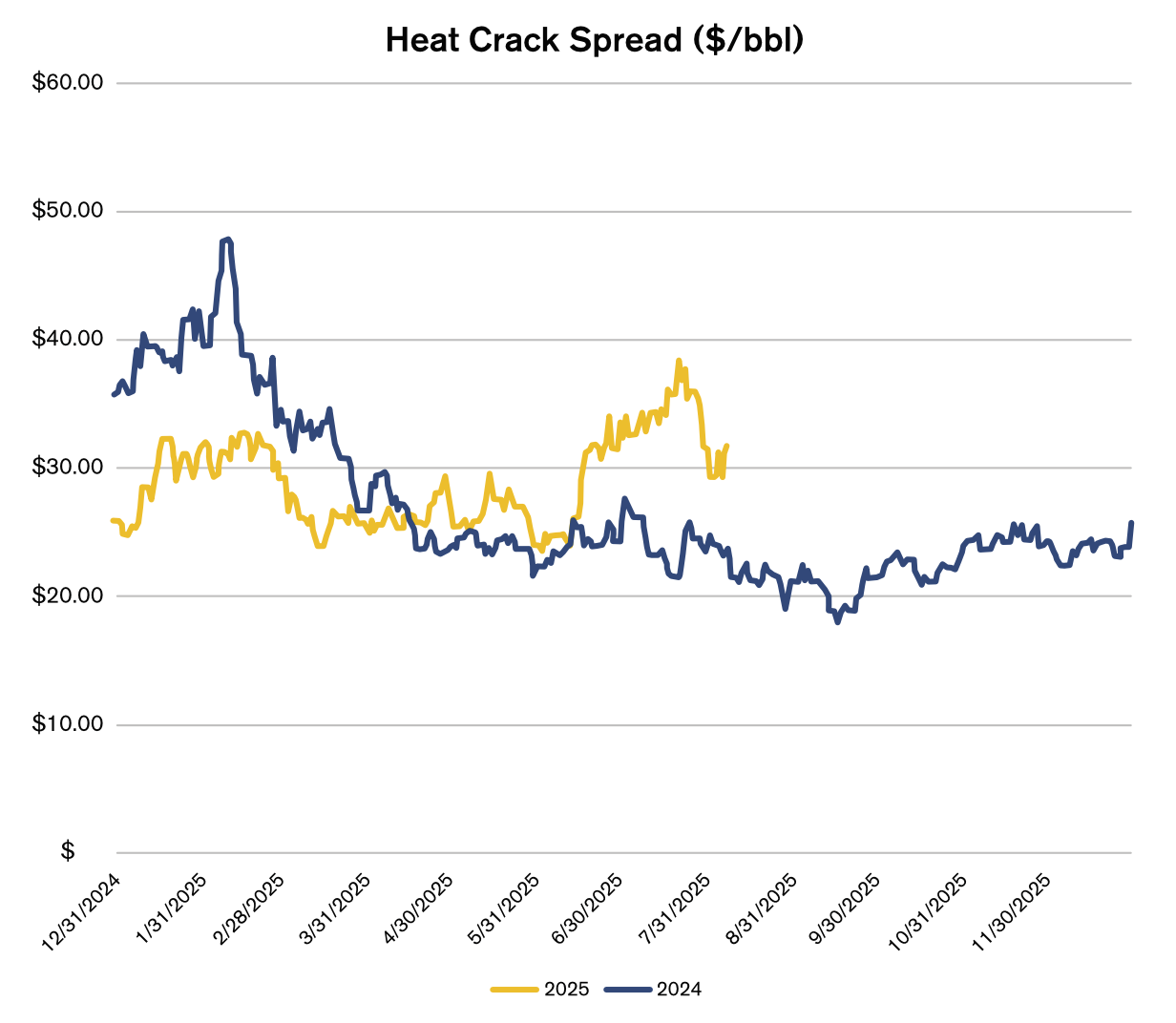

The market is already showing warning signs. The ULSD-WTI crack spread recently surged past the $30/bbl mark in mid-June and has remained elevated. This sharp premium indicates that refiners are being heavily rewarded for prioritizing diesel production. Meanwhile, the ULSD (HO) futures curve remains backwardated as front-month futures contracts have been trading significantly higher than later-dated months – a clear reflection of near-term supply tightness. This market structure provides economic disincentives for storage operations, which further adds pressure to an already tight physical market.

So, what can we expect heading into this winter? A surge in heating demand – particularly in the Northeast – could occur if colder-than-expected weather arrives early, while the Midwest harvest season is likely to boost agricultural diesel consumption. At the same time, the threat of weather-related disruptions, such as hurricanes or cold-weather outages at key refineries (particularly those in Texas or Louisiana), could severely impact production and distribution. Moreover, if Europe experiences another diesel supply shortfall, US exports could rise further, putting additional strain on domestic supply. Similar factors pushed ULSD prices above $5 per gallon in some markets in 2022. With inventories now even tighter and refining margins more volatile, a similar – or even more severe – price spike is increasingly possible.

Given the high risk of price volatility and supply disruptions this winter, businesses should consider implementing hedging strategies ahead of the heating season. Locking in prices through futures contracts, options, or structured products – such as fixed wet barrel purchase combined with a put option – can help protect against sharp moves in ULSD prices. Building a tailored risk management plan now can protect margins and ensure operational stability throughout the winter. In a market this tight, informed and timely action could make all the difference.

Anja Ristanovic is a Financial Analyst at risk management consultancy Hedge Solutions. She can be reached at 800-709-2949.

The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.