Losses in imports and lower production add additional pressure to anemic US inventories

During the 2022-2023 heating season, we saw U.S. distillate supplies fall to critically low levels, especially on the East Coast where consumer demand is highest. As the heating season approached, U.S. distillate export activity reached a five-year high in September. This led to a 25 percent spike in prices in late October and a significant deviation between the spot price and the futures price (basis) that lingered into early December (see Chart 1). The phenomenon, known as a “basis blowout,” occurs when the spread between the spot physical Ultra-Low Sulfur Heating Oil price (ULSHO) and the NYMEX HO futures contract price widens rapidly and unexpectedly. Last year, basis reached $0.74/gallon on November 7th. This can result in significant financial losses for market participants who are not prepared for such price volatility.

One of the primary drivers of the blowout is an unexpected imbalance between supply and demand, especially at a time when inventory levels are low. Disruptions to refinery operations and supply, geopolitical tensions, and changes in demand patterns can all lead to a significant divergence between the spot price and the futures contract price. Additionally, logistics and transportation play a significant role in energy markets, and any disruption to distribution, such as pipeline outages, can lead to supply shortages.

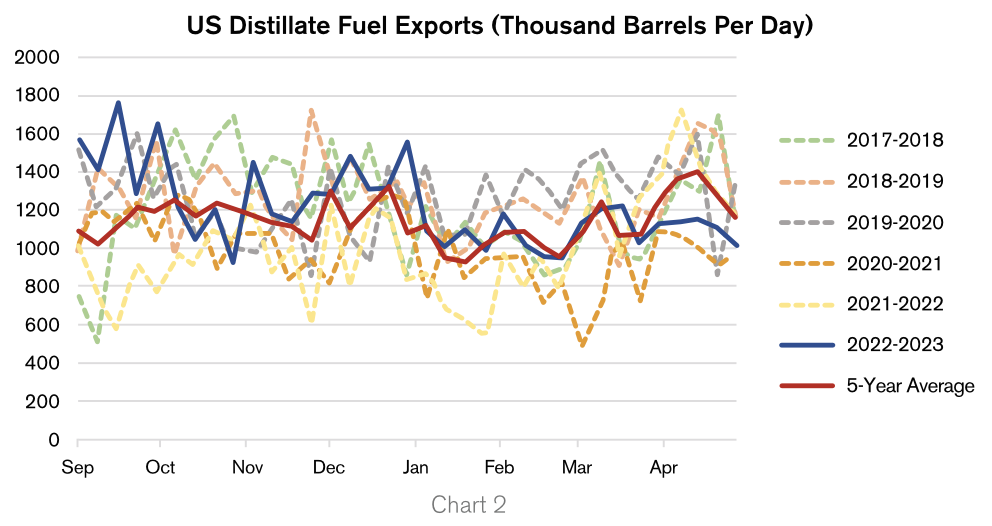

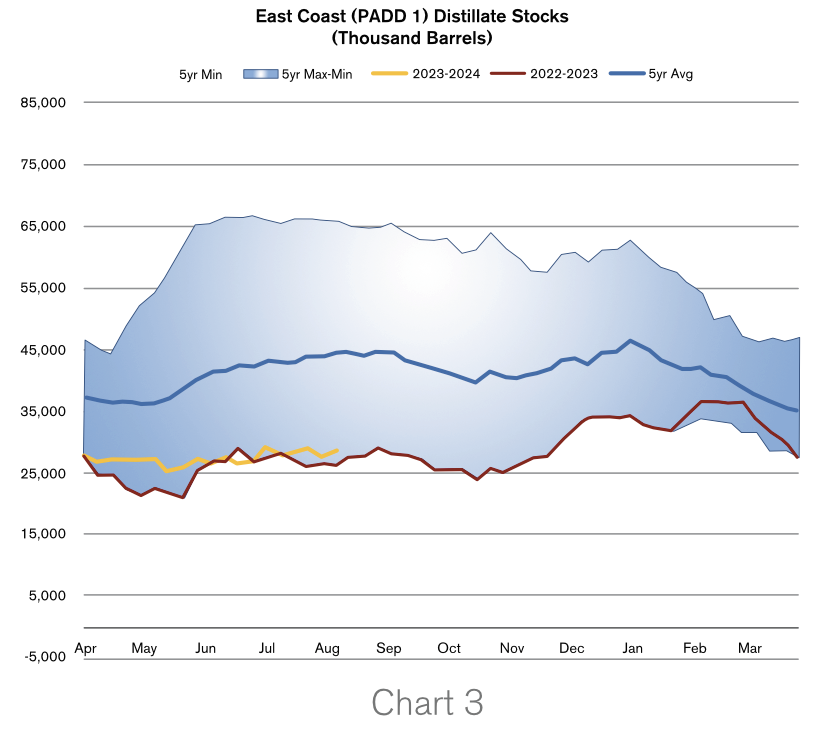

Last year, inventories in the U.S. fell to levels not seen since 1951, with the greatest deficits occurring in the Northeast. Despite refineries on the East Coast operating at maximum capacity, supply was still not sufficient to meet the demand. Slower diesel exports from China and sanctions on Russian products only intensified the problem. U.S. distillate exports were directed mainly to Europe, filling gaps left by Russian and Chinese supply. Market sentiment and speculation contributed significantly to price movements. Traders and investors react to news and forecasts, and their sudden “herd mentality” can move the markets in dramatic fashion over a short period of time.

As we head into another heating season, it makes sense to assess the health of the distillate market, including inventory and production data. As of August 11, 2023, U.S. distillate stocks hit 115.74 million barrels (mb), which is just 3.1 percent higher than last year’s weak levels and, notedly, 17.0 percent lower than the 5-year average this late in the building season. The deficit to the 5-year average has significantly widened from the 5.8 percent we saw in the early March reporting week. Roughly 25 percent of the total stockpiles are located on the East Coast (PADD 1). This is 9.1 percent higher than last year, but 35.8 percent below the norm. From May to early August, during which time inventories typically build, average US distillate production was running at 4.91mb/d, which was 2.9 percent lower compared to the year before. Additionally, imports were down 16.0 percent year-on-year, averaging just 0.13mb/d. On the other end of the equation, exports averaged 1.27mb/d during this period, down by 5.5 percent year-on-year, and implied demand was at a 2.0 percent deficit compared to last year, at 3.71mb/d. The significant loss in imports and lower production is adding additional pressure to anemic U.S. inventories.

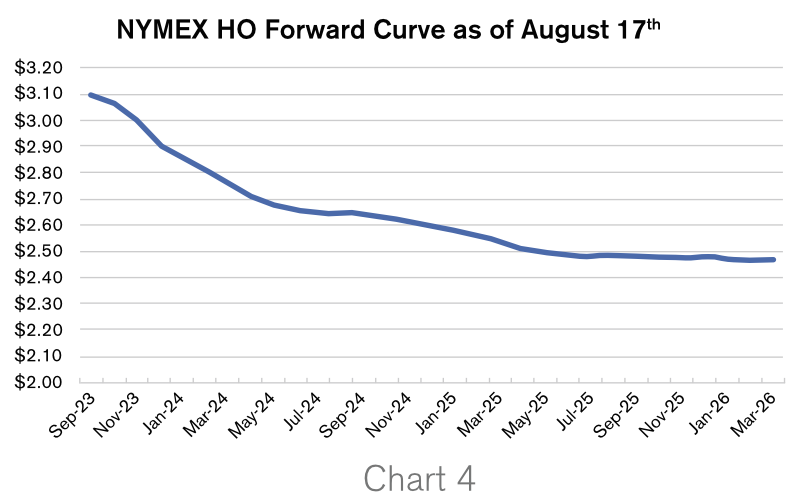

Stock levels serve as a cushion against unforeseen market events that could impact supplies and lead to sudden movements in prices. The weak August stock levels indicate a higher likelihood of a basis blowout occurring this upcoming winter, assuming all other factors remain constant. Additionally, the significant backwardation in the NYMEX HO futures forward curve provides economic disincentives for storage operations.

There are several different ways companies can protect themselves from these abrupt changes in either price or basis. When supply concerns are paramount, energy marketers should look at hedging basis and locking in supply contracts. It is important that these agreements incorporate transparent indices like the Nymex contracts or Argus, Platts or OPIS. It is critical to back test any offers from the supplier in historical context so that you are not committing to an agreement that is not competitive.

Note: source for all data in this article is: Department of Energy.

Anja Ristanovic is a Financial Analyst at risk management consultancy Hedge Solutions. She can be reached at 800-709-2949.

The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.