All

2022 Winter Fuels Outlook

Increased Energy Expenditures and Volatility Ahead

The 2022 winter season may see homeowners poised with their checkbooks, according to the U.S. Energy Information Administration’s (EIA) October Winter Fuels Outlook and the November and December Short Term Energy Outlook (STEO) updates. Two key factors contribute to heating expenses for consumers: how much a home needs to be heated, and what the cost is to do so. Both factors are likely to see growth in the coming months, according to the EIA.

Even though both the consumption and price of winter heating fuels are expected to increase this winter compared with last, the predominant driver of increased residential heating costs will likely be price fluctuations rather than increased demand, according to the analysis. For most fuel types (with electricity as a close exception), winter is the largest season for residential fuel consumption in the U.S. Whereas the October Outlook forecast a 27% increase in heating oil expenditures, the November STEO increased that to a whopping 45% increase over last winter. Other fuels are expected to increase as well: 5% for propane – this is alongside a 28% and 10% increase in costs of natural gas and electricity, respectively. These are nationwide calculations. The December STEO further warned of on-peak wholesale power prices for ISO New England to average $200 per megawatt hour in January, 35% more than January 2022. Per the report, “Capacity constraints on pipelines delivering natural gas into New England make it likely that wholesale electricity prices will be set by relatively expensive imported LNG or fuel oil.”

Colder Temperatures Spur Heating Needs

As the 2022 holiday season begins, the U.S. is likely to experience colder weather than in recent years, according to experts. The U.S. National Oceanic and Atmospheric Administration (NOAA) forecasts that temperatures in the Northeast, Midwest, and West will be between five and six percent colder than last winter, and a whopping 9% colder in the South. The need for additional heating due to colder weather will likely result in higher consumption of heating fuels.

To translate temperature into home-heating needs, cold weather impacts home heating costs in two ways. First, more energy is required to keep a home at a specific temperature when it’s colder outside. Second, colder temperatures increase demand for home-heating fuels, which strains supplies and can increase costs.

Oil And Propane Costs Set to Increase

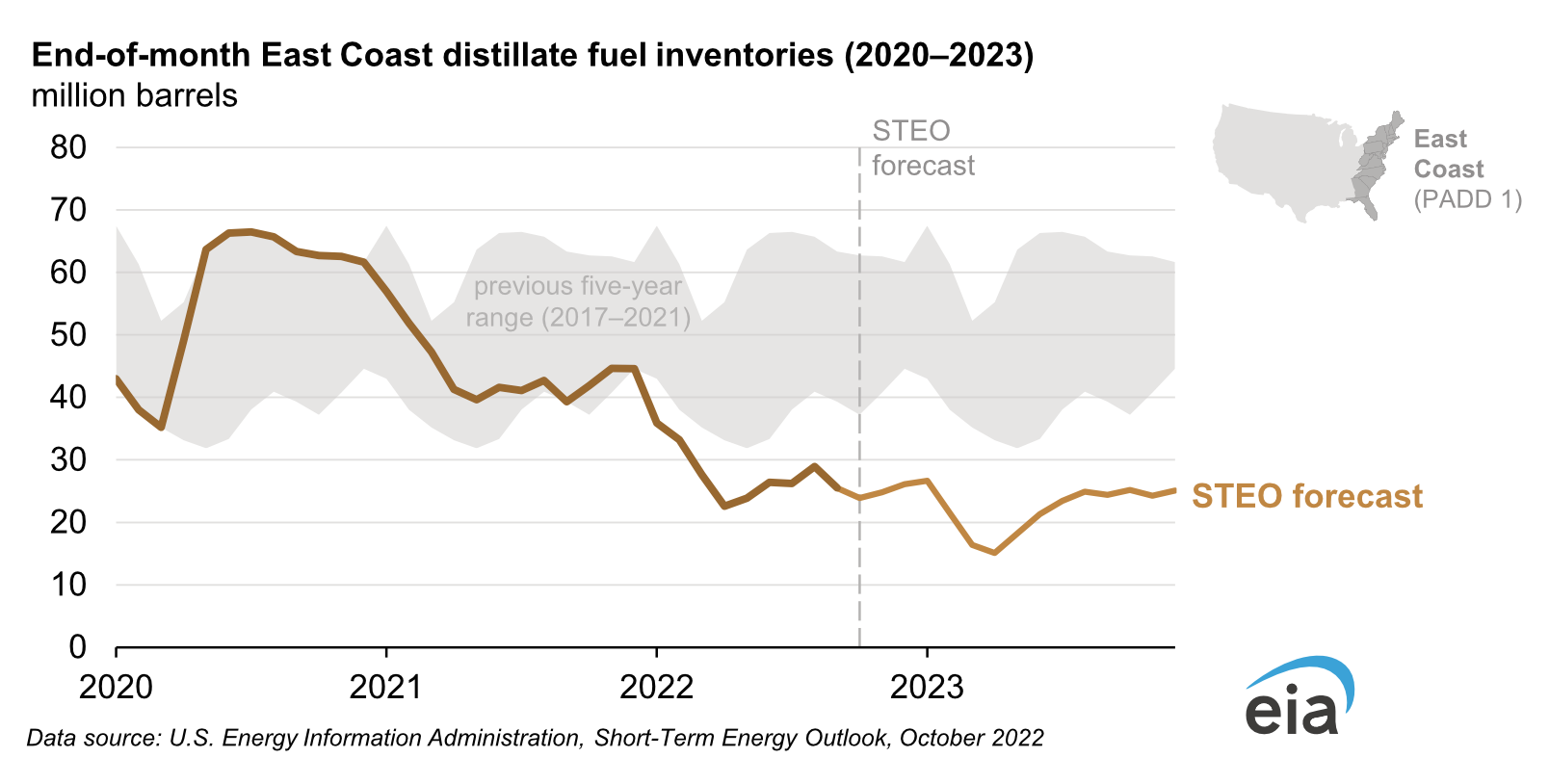

While only approximately 4% of households across the country use heating oil as their primary space-heating fuel, in the Northeast, 18% of households use heating oil. Users of heating oil will likely spend, on average, as much as 45% more than last winter. Mostly responsible for this are year-over-year increases in the retail cost, even with anticipated reductions in distillate prices in the first half of 2023. At present the EIA is hedging all price and supply forecasts with a warning that the EU’s ban on seaborne imports of petroleum products from Russia creates supply uncertainty for the markets.

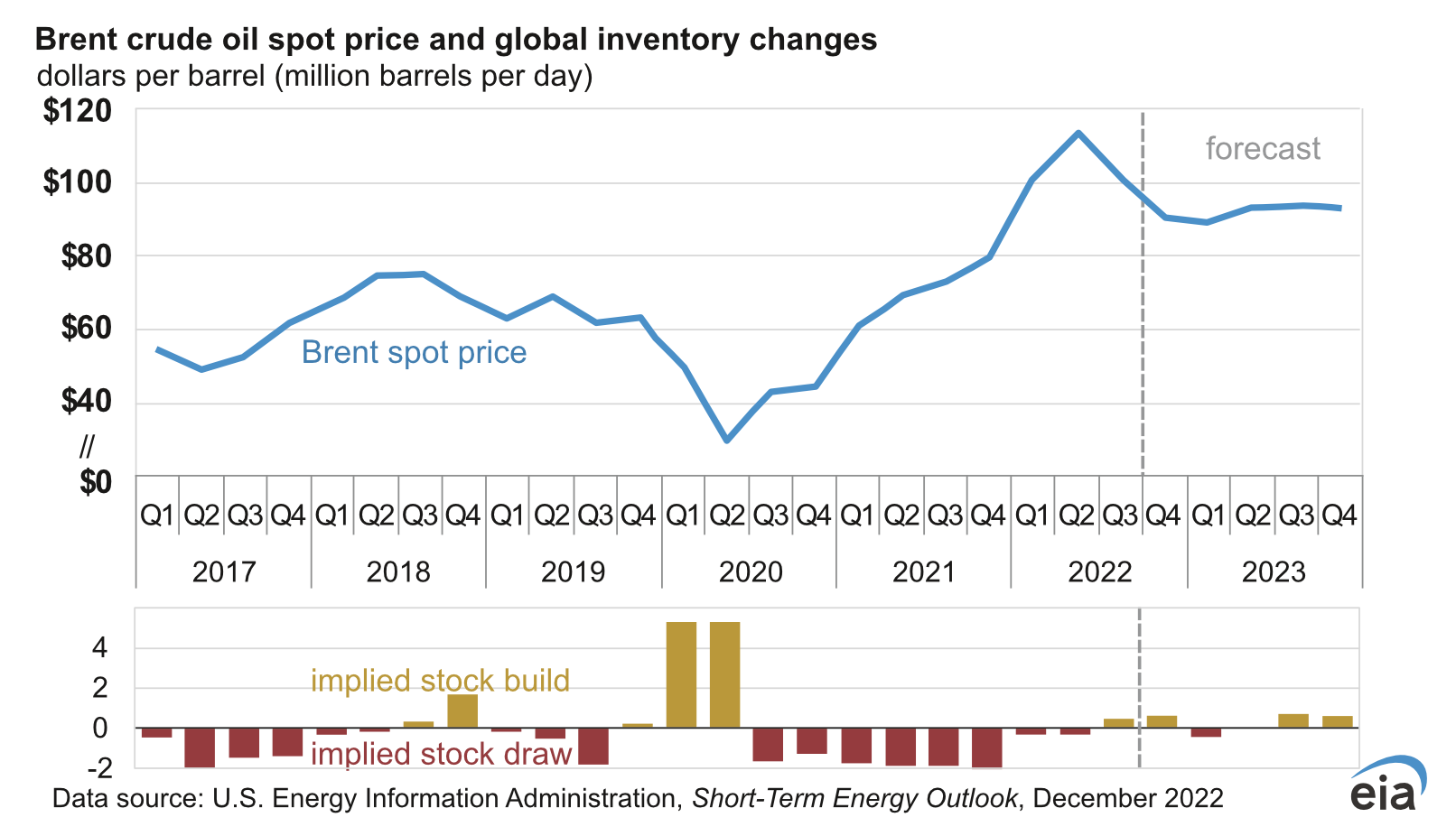

Furthermore, although OPEC crude oil production will fall in November and December, the EIA is anticipating a slight increase of 0.3 million b/d in 2022 over 2023. Growth in production in U.S. and non-OPEC regions combined with the increases from OPEC could lead to a softening of prices in early 2023, but Brent crude oil price will start to rise again in the second half of the year.

Distillate fuel refineries in the Northeast have declined and shuttered in recent years, and importation of fuel supplies has also been low. This, combined with seasonal distillate consumption skewing toward earlier in the year, has left Northeast inventories 57% below the most recent five-year average. Falling global inventories of oil in early 2023 are expected to push Brent prices above $90/b as we enter the second quarter of 2023. Forecasted rising oil inventories might exert some downward price pressures, but those “will likely be balanced by the ongoing possibility of supply disruptions or production growth that is slower than our forecast,” per the December STEO.

Forecasted average household expenditures on propane this winter, at $1,668, are second only to heating oil. However, the similarity stops there. While heating oil expenditures are expected to jump as much as 45% over the prior winter season, propane is expected to be up just 5% year over year. Just 5% of households in the U.S. use primarily propane to heat their homes. Unlike the other fuel types in the Outlook report, propane’s changing costs for consumers would be driven mostly by the increased consumption from colder weather. Across regions, little effect is expected from price volatility.

In the Northeast, propane expenditures are expected to grow by 8%, driven half by consumption of fuel and half by changing prices. In the South, prices are expected to decline by 3%, with a 7% increase in consumption. Midwest prices are expected to remain steady since the previous year, with a slight 4% increase in consumption averaged across the region. The winter months for propane are typically influenced by consumption for home heating and agricultural drying of grain (which occurs early in winter). Balancing increases in expected home heating from a colder winter, lower need for crop drying due to a poor harvest and dry weather, and increased petrochemical production needs that also use the feedstock, total demand for propane is expected to increase by 2% across regions and sectors. The global demand for propane in the petrochemical sector has recently grown, leading to increased exports of U.S. propane and lower than usual inventories going into this winter, as well.

The propane dynamics this winter will depend heavily on the realized weather forecast as winter progresses. Due to low-standing inventories, increased demand due to more heating degree days could result in increased wholesale prices, which would be rapidly passed on to consumers.

Natural gas and electricity

Nearly half of U.S. households, those that rely on primarily natural gas, can expect to see an average increase of 28% in fuel spending compared to last winter. Five of those percentage points can be explained by increases in consumption. Most of the change can instead be attributed to changing prices in the various regions, even considering the relatively slow trickle of wholesale spot price changes down to consumers (compared to heating oil and propane, see above). Furthermore, increases in natural gas supply are likely to be largely canceled out by the increasing consumption from colder weather. However, prices are likely to come back down later in the winter.

This winter, electricity consumption is expected to increase by 4%, with residential electricity prices rising 6%, resulting in an overall increase in expenditures by 10%. This is significant, with nearly four in ten households in the U.S. relying primarily on electricity for home heating in some form, including electric heat pumps or electric resistance heaters.

Although renewables, such as wind and solar, are the fastest growing energy sources for electricity in the U.S., natural gas still provides the largest share. Natural gas generation is expected to remain at record levels during this winter because of restrictions on coal-fired power plants. Natural gas is forecasted to contribute 36% of total generation during the winter months of 2022–2023, whereas the U.S. electric power sector will have 26% more solar generating capacity, and a 9% increase in wind power capacity, which together contribute to 16% of U.S. total generation.

So, where does this leave homeowners?

Though prices are expected to increase, the proof will be in the meteorological pudding. A colder winter than anticipated will spell higher home-heating costs associated with the number of heating degree days. A warmer winter the opposite. The Outlook report includes projections for what will happen if this winter is 10% colder versus 10% warmer than the forecasts. Additionally, price volatility may be the biggest driver overall. This is especially true in areas where inventories are low, given the unpredictability of current geopolitical factors such as the war on Ukraine – a fact that could bring wide changes in wholesale and retail prices for fuels.

Related Posts

Why Quality Matters in Your Biofuel Blends

Why Quality Matters in Your Biofuel Blends

Posted on June 25, 2025

Incorporating Higher Blends of Biofuels

Incorporating Higher Blends of Biofuels

Posted on May 14, 2025

NORA Programs at Eastern Energy Expo

NORA Programs at Eastern Energy Expo

Posted on May 13, 2025

March Short-Term Energy Outlook

March Short-Term Energy Outlook

Posted on April 28, 2025

Enter your email to receive important news and article updates.