With online enrollment, price protection and budget plans, you can reduce risk and increase customer retention

Right now, you are most likely in the middle of planning for next season: securing price protection contracts and budget plan enrollments from customers, and working with your hedge advisors and supply partners to ensure gallons at the most advantageous prices you can negotiate.

Does it sometimes feel as if you are juggling flaming torches while walking a high wire? Wouldn’t it be nice if you could make some order out of pricing and payment agreements?

There is a way to make price protection and budget plan enrollments faster, easier, and more accessible. What it takes is having the right systems in place to automate the process and execute contracts in real-time to minimize your exposure to market volatility.

Increase Customer Retention

It has long been understood that price protection and payment plans are among the best customer retention options available to home heating fuel providers. One report has estimated that customers with a pricing or budget plan and service contract stay with their company for an average of 10 years, while those without have a lifespan of less than two years.

The 2024 Gray, Gray, & Gray, LLC Energy Survey revealed that 63 percent of customers are staying with their provider for five years or longer. That is a great statistic! On the other hand, 59 percent of customers have switched to a competitor with similar or lower prices, and 30 percent have been lost to gas or heat pump conversions.

What if you could get those customers to stay?

If customers on budget and price protection plans stay five times longer than those without, the clearest way to increase retention is to increase enrollment in these programs. There is certainly room for improvement: 83 percent of respondents to last year’s survey had fewer than 40 percent of their customers on a budget plan, and 45 percent had 20 percent or fewer. The statistics were similar for price protection: 79 percent of respondents had 40 percent or fewer enrolled in price protection, of which 39 percent had 20 percent or fewer, and 17 percent had no price protection enrollments at all.

Increasing those enrollment numbers by even a few percentage points could make a big difference in your company’s retention statistics – one of the best markers of company strength.

Reduce Company Price Risks

Market volatility is always a concern, and every year it seems that volatility is more fraught than in previous seasons. As of this writing, there are concerns about the Middle East and Iran, Russia and Ukraine, OPEC+ production levels, and current and threatened tariffs on steel, vehicles and vehicle parts, heating equipment, and more. In early June, the Energy Information Administration forecast Brent Crude averaging $66/b for 2025 and $59/b in 2026, but that was before Israel and the United States bombed Iranian nuclear sites. Will there be fallout from that action, and what is the potential of Iran closing the Gulf of Hormuz?

It is prudent for you to lock in your future contracts and fuel supply, and lock in as many customers as possible in some budget or pricing plan that will contractually tie them to you for the next season.

Providing price protection agreements via the old “mail, sign, and return” process – even if you are sending a PDF contract to be signed – there is an untenable time lapse between when you create the contract and provide the customer their price, and when you receive the signed contract. This creates risk for you when market volatility is prevalent.

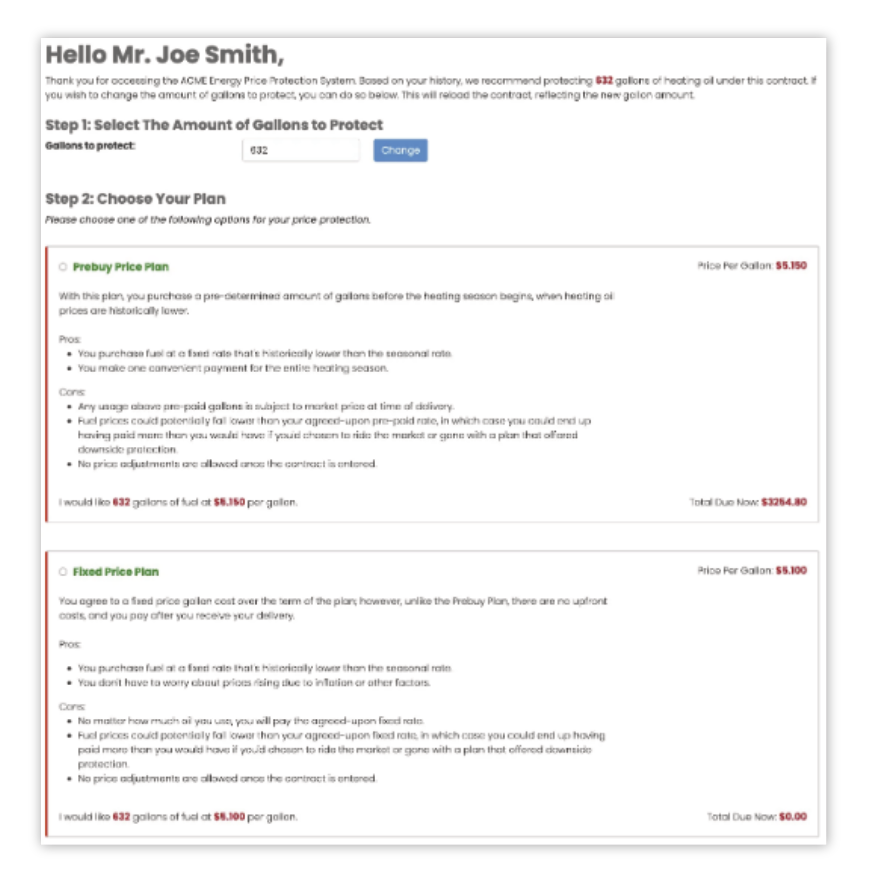

However, if you have an online price protection and/or budget enrollment system, the contract can be developed in real time based on your pricing parameters and include an “offer expiration date” to limit your risk. This creates a sense of urgency for the homeowner, who can click through on the enrollment portal to complete and sign the agreement immediately.

The portal also provides you with the ability to adjust pricing as often as needed to meet changing market conditions. But, beyond setting the price, the system can automate the rest of the contract development, reducing the chance for human error.

There are many other ways an online price protection or budget plan enrollment portal can protect your company’s finances, giving you the ability to:

- Integrate budget and price protection plans directly with your CRM: ADD Systems, Blue Cow, Cargas, Automated Wireless, Fuel Data Systems, and more.

- Write back agreement terms to CRM, as applicable.*

- Reduce employee time and overhead costs in addition to paper and postal expenses, as the need to print and mail contracts is virtually eliminated.

- Protect your business against market volatility and secure a reliable cash flow with real-time binding contracts that utilize your existing terms and conditions.

- Offer multiple pricing options: market-budget, fixed, pre-buy, capped, capped-budget, fixed-budget.

- Include service contract pricing in monthly budgets.

- Automate pricing adjustments and discounts by contract type, gallons protected/volume, site location, veteran, or senior citizen status, and more.

- Add administrative or enrollment fees as a single upfront payment or adjust pricing for a per-gallon upcharge.

- Set contract gallon requirements: minimums, maximums, or percentage of previous year’s gallons.

- Integrate contracts for multiple fuels: heating oil/Bioheat® fuel, propane, kerosene, diesel/biodiesel.

- Track protected gallons and report that against your hedging accounts.

- Review and filter customized reports by open/completed status, date presented, date completed, gallons, and more.

- Allow authorized users to override any default contract setting: gallons, pricing, etc.

- Connect the price protection or budget enrollment platform with your payment gateways to immediately collect any required payments.

*Write-back functionality subject to account management system/enterprise software capabilities.

Make It Easier for Your Customers

Customers like taking the easiest option. Online price protection and budget plan enrollment makes it easy for your customers!

They can access the service through an ad, social media post, text message or email, or through your existing online customer portal.

The price protection or budget portal will automatically populate the agreement with the customer’s account information, recommended gallons, fixed or capped price or estimated annual cost, and present it for the customer’s digital signature.

The customer can accept and sign the contract as offered or adjust gallons, within your pre-set parameters, at which point the price protection platform will automatically revise the contract’s pricing, monthly costs, etc.

The entire process can be completed in a few minutes, and the digital signatures on the agreements are legally binding.

Get the Word Out!

To secure more enrollments in your pricing program, you need to make sure your customers are aware of your offers, can see their anticipated monthly cost, and can quickly and easily sign up.

Consider targeted campaigns directed to those customers who are not yet enrolled in a pricing or payment plan. Whether taking the form of automated programmatic advertising, email or text messaging, or personalized marketing on an account portal, successfully communicating the benefits provided by a price protection or budget plan makes certain that the value-added programs you invest in deliver not only for your customers, but for your bottom line as well.

Bring it Full Circle for Full Customer Service

Price protection and budget plan enrollment platforms pull the necessary data directly from your CRM. They can be integrated with your existing online customer account management platform, assuming that both have been developed by the same partner.

If you do not already have an online portal for customer payments, account management and transaction history (and more), you should consider taking advantage of the economies of scale to have one developed at the same time as your pricing and payment plan enrollment services.

Additionally, if your account management platform includes an integrated new customer enrollment module, price protection and budget plan enrollment can be offered as an option, subject to administrator review.

These new agreements can also be integrated with your automatic payment authorizations, bill presentment and payment services, and payment-based loyalty programs.

These services give you more flexibility in pricing to respond to changing conditions, promote quicker responses from the customer, store digital copies of each contract, and send a PDF to your customer. The process could not be simpler: you supply the customer information through your back end and set the parameters that work best for your company, the client logs in, and the price protection and/or budget plan enrollment system does the rest.

Richard Rutigliano is President of PriMedia, Inc., an integrated marketing and communications firm specializing in the home energy sector and offering a wide array of SaaS products nationwide. He can be reached at 516-222-2041 or rrutigliano@primediany.com.