Lower prices and lower expenditures forecast for homes using heating oil and propane

In October 2025, the Energy Information Administration released their Winter Fuels Outlook. Oil & Energy has reviewed the full document to provide the excerpts presented below.

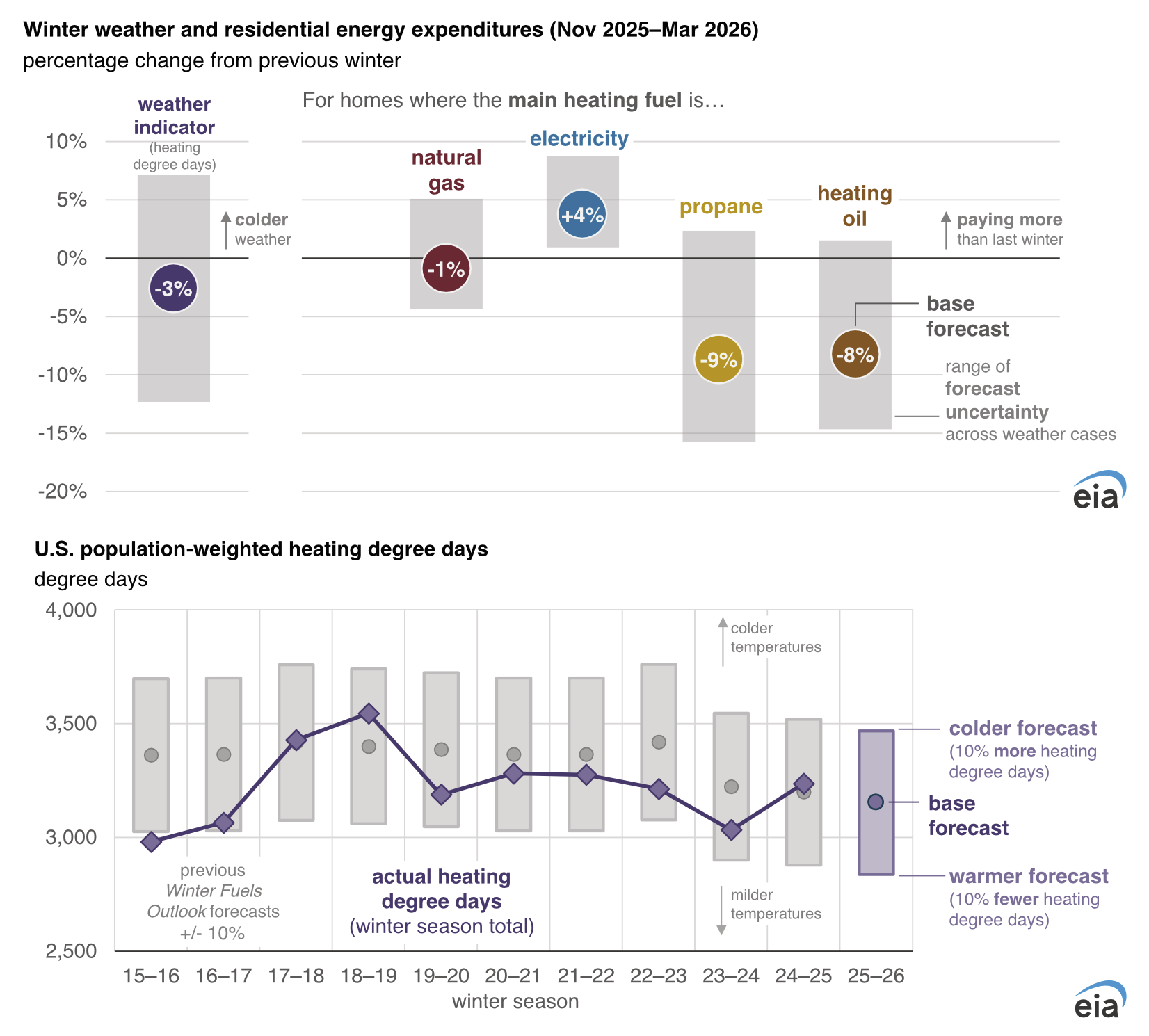

We expect winter temperatures and therefore residential energy consumption will broadly be similar to last winter, so much of the change in expected expenditures is driven by energy prices. Residential sector retail prices for electricity are higher than last winter across the country, natural gas prices are generally similar to last winter, and propane and heating oil are lower.

We expect that U.S. households heating with natural gas will spend about the same amount on natural gas this winter as they did last winter. Households heating with electricity will spend more, and households heating with propane or heating oil will spend less than they did last winter. These outcomes are different in our cases that assume colder or milder winter weather, except in the case of electricity, where we expect households to pay more than they did last winter across our range of weather assumptions.

Fuel inventories are an important source of winter supply. More natural gas and propane are currently stored in U.S. inventories compared with their previous five-year (2020–2024) average going into this winter. These relatively high inventories have helped keep prices for those fuels below year-ago levels. However, distillate fuel inventories, a category which includes heating oil, are slightly below their five-year average. We expect heating oil prices to be lower than last year, however, because of our lower crude oil price forecast.

We assume this winter will be slightly milder than the last winter across much of the country, especially in the Northeast.

Weather can affect household heating expenses in two ways. First, cold weather raises the amount of energy required to keep a house at a specific temperature. Second, because cold weather raises aggregate demand and can disrupt supply, it can cause energy prices to rise. These price increases can be more severe if fuel inventories are relatively low. In the cases we consider, we adjust for both effects.

In our outlook, we expect 5% fewer Heating Degree Days (HDDs) in the Northeast this winter, 3% fewer in the South, and 1% fewer in both the Midwest and West.

Because weather is a significant source of uncertainty in these forecasts, the Winter Fuels Outlook includes two side cases where, measured in HDDs, all regions are either 10% colder or 10% warmer than the base forecast. Of the previous 10 winters, 9 winters have fallen within that 10% warmer or 10% colder range, relative to the forecasts we publish at this time of year (October).

Propane and heating oil are the primary space heating fuels in a much smaller share of homes nationally but are used widely in regions that tend to have some of the coldest winters. Heating with propane is more common in the upper Midwest and Northeast. Heating oil is used for residential heating mostly in the Northeast.

Energy Expenditures

The consumption and expenditure forecasts in the Winter Fuels Outlook apply to a home’s main space heating fuel. For most households, the main space heating fuel is also used for other purposes. Households primarily heating with natural gas equipment, for example, may also use natural gas for water heating, cooking, or clothes drying.

The consumption and expenditure forecasts in this report are further categorized into space heating and other purposes. In households heating with natural gas, propane, and heating oil, space heating accounts for most of the winter-season energy consumption and expenditures across the country. In homes heating with electricity, however, space heating represents a smaller portion of total consumption, especially in regions with relatively mild winters such as the South.

Wholesale price changes for heating oil and propane are passed to consumers quickly because rates in those markets are not regulated as they are for natural gas and electricity. We generally estimate that changes in wholesale fuel prices become fully reflected in retail prices over a period of four to six weeks.

Many heating oil and propane users buy supplies ahead of the winter and refill as needed. When forecasting expenditures, our calculations do not account for fuel that consumers purchase ahead of its use or fuel that was contracted at prices set before the start of the winter. We assume households pay the prevailing retail price for heating oil and propane at the time they use it.

Propane

- Retail propane prices are lower this winter than last winter, following the trend in propane spot prices.

- Slightly milder winter weather also contributes to our expectation that propane expenditures will be less than last year’s in the base case.

- Propane inventories are above their five-year average despite increased demand for propane for agricultural uses, especially grain drying.

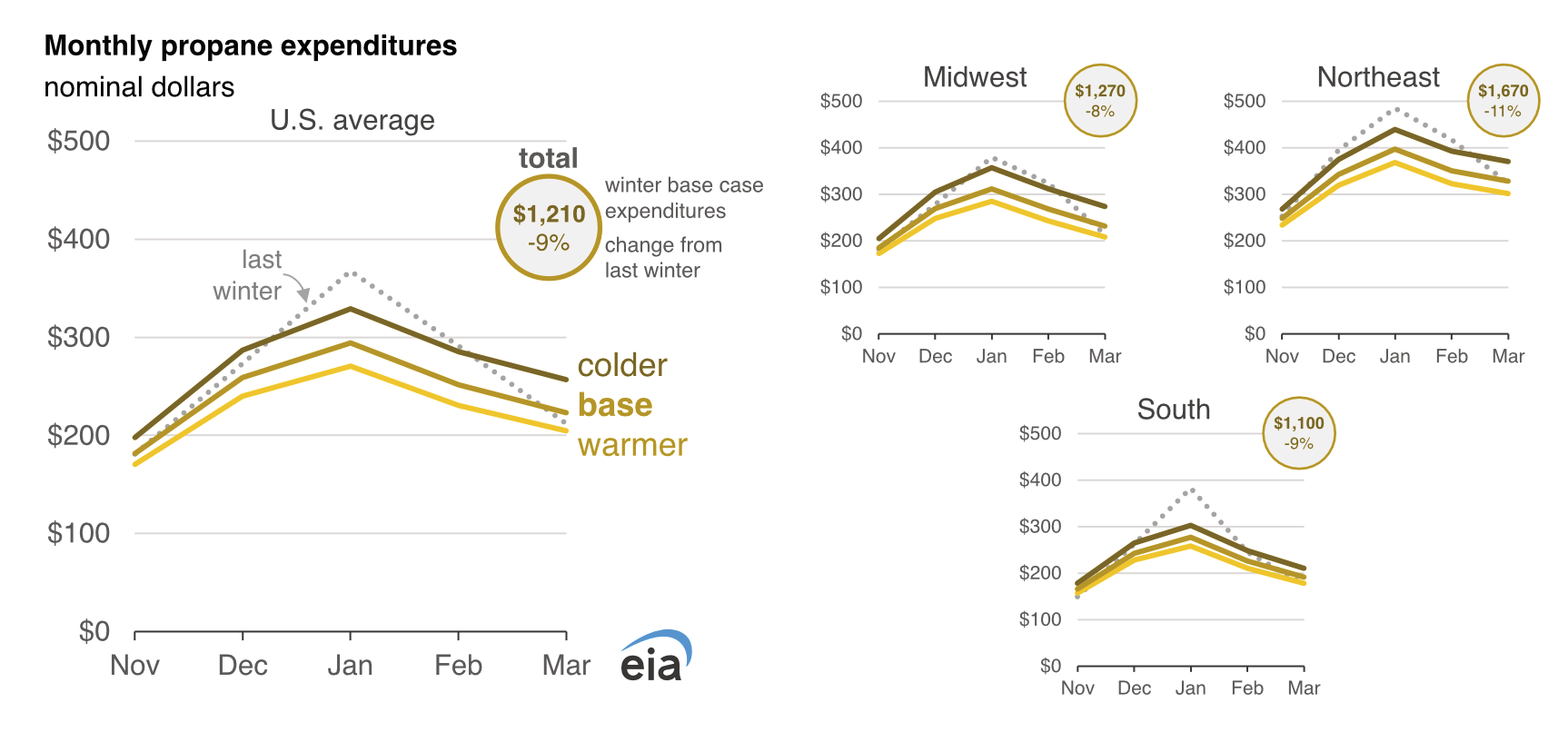

In our base case forecast, we expect households heating primarily with propane will pay less than they did last winter on average across the United States, primarily as a result of lower prices. Propane is used as a heating fuel in 5% of U.S. households, mostly in rural areas.

The Midwest has the highest share of homes that use propane as the main heating fuel, and in our base case, we expect that homes in the Midwest will spend 8% less on propane compared with last winter. We expect homes in the Midwest will consume about the same amount of propane as last year because of a similar temperature forecast to last winter.

In the Northeast, we expect households to spend 11% less this winter, the largest decrease among the regions, because of less consumption and lower prices. We expect households in the South to spend 9% less on propane this winter. In the colder scenario, these expectations shift to values that are closer to or more than last winter’s propane expenditures, especially in the Midwest, where propane expenditures would be 6% more than last winter with colder weather assumptions.

Because propane can be produced from both crude oil and natural gas, propane prices typically follow the prices of crude oil and natural gas but can vary significantly depending on supply and demand conditions, particularly in response to winter weather. We expect the U.S. average retail propane price will average $2.46 per gallon (gal) throughout the winter, 7% less than the previous winter.

The Midwest often has lower retail propane prices than other regions. We forecast the Midwest retail price will average just under $2.00/gal this winter. The Midwest has a network of propane distribution hubs throughout the region, making retail supply more accessible compared with other regions.

Propane inventories typically build from April to September, when propane consumption is relatively low, and fall during the winter. At the end of September, U.S. propane inventories totaled 103 million barrels, 12 million barrels more than the previous five-year average. We forecast that U.S. propane inventories will remain well above their previous five-year average throughout the winter.

High propane inventory levels have helped keep propane prices relatively low this year, a trend we expect to continue throughout this winter unless temperatures are much colder than our base case forecast. We forecast U.S. propane production to increase by about 2% this winter compared with last winter and for U.S. propane consumption to fall by 12% because of less propane consumption in the residential and commercial sectors.

In the early winter, we assume increased use of propane for crop drying will offset some of the drop in space heating consumption. In October and November, propane is consumed in commercial grain dryers when the corn harvest takes place, and we expect slightly more grain drying demand for propane at the start of this winter because the U.S. Department of Agriculture expects a relatively large corn harvest.

In our Short-Term Energy Outlook, we forecast retail propane prices in October through March, as those months coincide with our weekly survey of propane prices in our Heating Oil and Propane Update. Retail propane prices at the beginning of the winter generally reflect trends in the wholesale price. We forecast that the wholesale price of propane at Mont Belvieu, Texas, for this October will be 14% less than it was it was in October 2024 and the U.S. average residential propane price will be 12% less than last year.

During the winter months, retail propane prices tend to increase. We expect the residential propane price to increase from $2.13/gal in October to $2.58/gal in March 2026, despite relatively little change in the wholesale price. Similar patterns occurred in previous years when retail prices increased during the winter despite smaller changes in wholesale propane prices.

Heating Oil

- We forecast retail heating oil prices will be lower this year because of lower crude oil prices.

- Residential heating oil consumption is highly concentrated in the Northeast, where we expect milder winter weather will contribute to lower heating oil expenditures.

- Northeast inventories of distillate fuel oil are lower than they were last year, contributing to some uncertainty in our outlook, but we expect inventories will remain sufficient to supply the Northeast heating oil market.

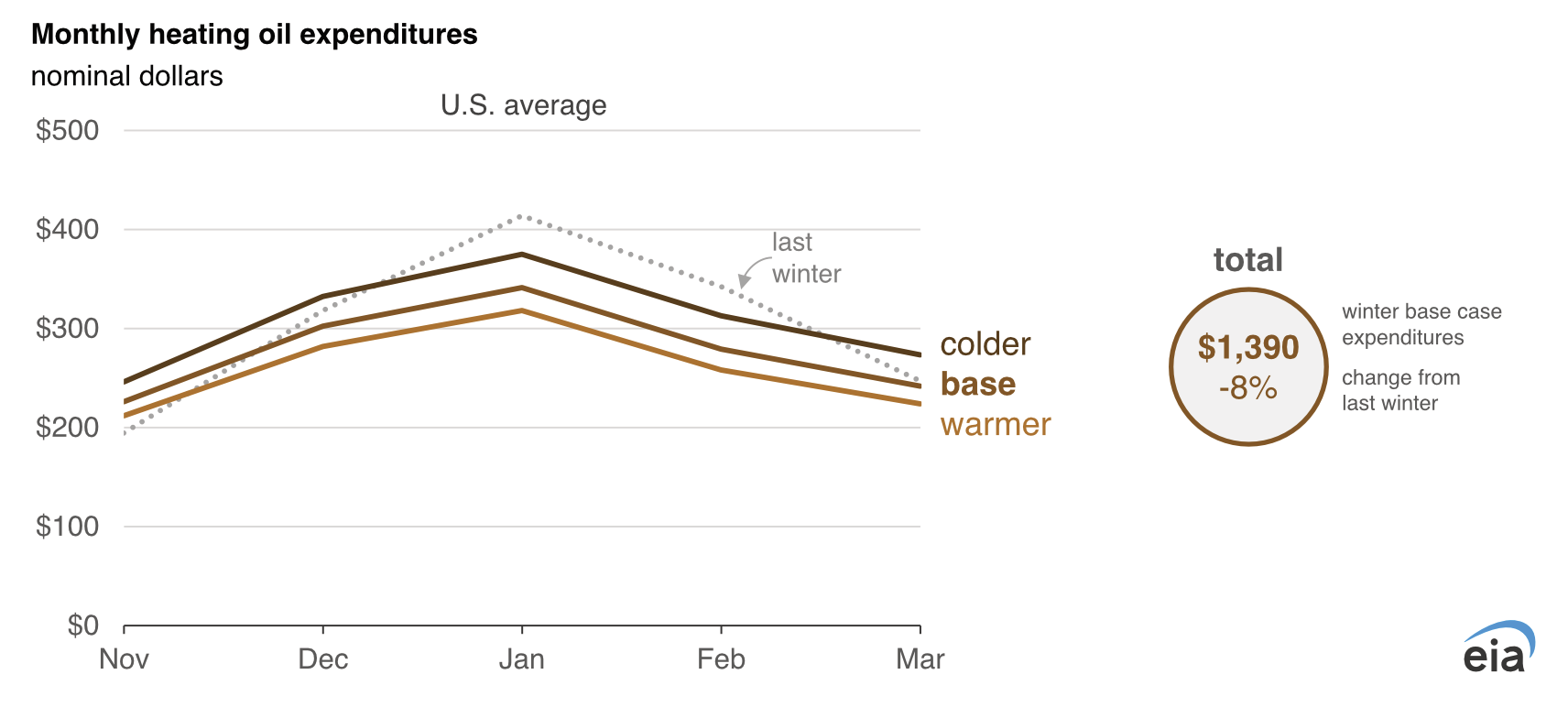

Heating oil, a variation of distillate fuel oil or diesel, is the primary space heating fuel for 3% of U.S. households. We expect these homes will spend 8% less on heating oil this winter than last. More than 80% of the homes that use heating oil as their main heating fuel are in the Northeast.

Even though we publish heating oil consumption as a U.S. average, the lack of consumption outside of the Northeast means the U.S. average heating oil price is heavily weighted toward the Northeast and corresponds closely to the Northeast regional average price.

Lower heating oil prices and less heating oil consumption drive lower heating oil expenditures in our base case forecast. We estimate that U.S. households that use heating oil for space heating will consume an average of about 400 gallons (gal) of heating oil this winter, or 4% less than last winter. We expect heating oil prices will average about $3.50/gal, 4% less than last winter. At this price, homes that primarily heat with heating oil will spend an average of $1,390 this winter.

In our colder case, we expect the average household using heating oil as its primary heating fuel will consume 4% more heating oil than last winter. Although we expect heating oil prices will be 3% less than last winter in that case, the increase in consumption means heating oil expenditures would be 2% more than last winter. Conversely, in our warmer case, we estimate heating oil consumption would be 10% less than last winter and prices 5% lower, resulting in expenditures decreasing by 15% from last winter.

Lower heating oil prices reflect lower crude oil prices this winter. However, we forecast this drop in crude oil prices will be partly offset by wider crack spreads for distillate fuel. Crack spreads broadly indicate refiners’ margins and are calculated by subtracting the price of crude oil from the wholesale price of a petroleum product. We expect crack spreads will increase this winter relative to last winter. For consumers, wider refining margins translate to higher prices for petroleum products.

Inventories of distillate fuel oil on the East Coast (PADD 1) remain below the five-year average for this time of year. Although we expect refinery runs to decrease in line with seasonal trends, we don’t expect refinery maintenance that would delay production this winter.

The East Coast region has only 5% of the United States’ refining capacity and most of that capacity is concentrated in New Jersey and Pennsylvania. Additional supply of distillate in the Northeast generally comes by pipeline from elsewhere in the United States, especially from the U.S. Gulf Coast (PADD 3). In particular, the Colonial Pipeline system extends from the Gulf Coast to as far as New York Harbor. Imports from eastern Canada are also a crucial source of Northeast regional supplies, which enter the region through maritime imports into Boston and other coastal ports.

Trends in heating oil prices tend to follow crude oil prices, which are subject to uncertainty associated with global petroleum markets. Possible changes in the outlook for crude oil prices or supply shortfalls on the global distillate market present a source of uncertainty that could contribute to higher-than-expected distillate prices. Any increase in global distillate prices is likely to translate to higher domestic heating oil prices.