In the January 2019 update of its Short-Term Energy Outlook (STEO), the U.S. Energy Information Administration (EIA) includes the effects that upcoming changes to marine fuel sulfur specifications will have on crude oil and petroleum product markets. Set to go into effect January 1, 2020, the new International Marine Organization (IMO) regulations limit the sulfur content in marine fuels used by ocean-going vessels to 0.5% by weight, a reduction from the previous limit of 3.5%. The change in fuel specification is expected to put upward pressure on diesel margins and modest upward pressure on crude oil prices in late 2019 and early 2020.

Residual oil — the long-chain hydrocarbons remaining after lighter and shorter hydrocarbons such as gasoline and diesel have been separated from crude oil — accounts for the largest component of marine fuels, also known as bunker fuels, used by large ocean-going vessels. Marine vessels account for about 4% of global oil demand. Removing sulfur from residual oils or upgrading them to more valuable lighter products such as diesel and gasoline can be an expensive and capital-intensive process. Refineries have two options for residual oils. They can either invest in more downstream units to upgrade residual oils into more valuable products, or they can process lighter and sweeter crude oils, which produce less residual oils and the sulfur content therein.

EIA expects that once implemented, the new IMO fuel specification will widen discounts between light-sweet crude oil and heavy-sour crude oil grades, while also widening the price spreads between high- and low-sulfur petroleum products. In the January STEO forecast, Brent crude oil spot prices increase from an average of $61 per barrel (b) in 2019 to $65/b in 2020, and about $2.50/b of this increase is attributable to higher demand for light-sweet crude oils that are priced off of Brent.

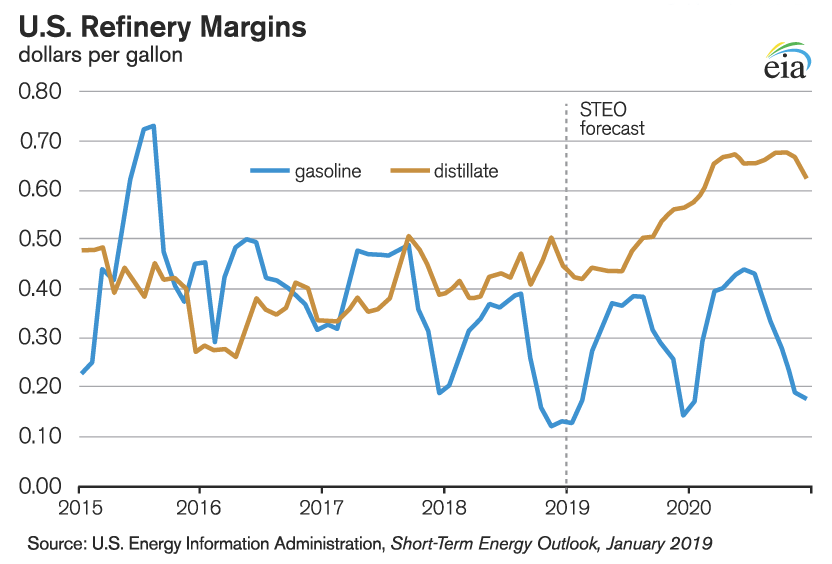

Because of an increased premium on low-sulfur fuels, EIA expects diesel fuel refining margins will increase from an average of 43 cents per gallon (gal) in 2018 to 48 cents/gal in 2019 and to 65 cents/gal in 2020. Motor gasoline margins averaged 28 cents/gal in 2018 and will increase slightly to an average of 32 cents/gal by 2020. EIA’s analysis indicates that the price effects that result from implementing this new standard will be most acute in 2020 and will diminish over time. As they maximize production of diesel fuel, refineries will increase distillate fuel refinery yields from an average of 29.5% in 2018 to 29.9% in 2019 to 31.5% in 2020, while motor gasoline yields will fall from an average of 46.9% in 2018 to averages of 46.5% in 2019 and 45.6% in 2020. Residual fuel yields will decrease from an average of 2.4% in 2018 to an average of 2.2% in 2020.

To meet increased demand for low-sulfur fuels, EIA expects that gross inputs into refineries will increase from an average of 17.3 million barrels per day (b/d) in 2018 to a record level of 17.9 million b/d (up 3.6%) on average in 2020. This increase in gross inputs will result in refinery utilization increasing from an average of 92% in 2019 to an average of 96% in 2020. As refiners use discounted higher sulfur fuel oil volumes, unfinished oil inputs into refineries will increase from an average of 0.33 million b/d in 2018 to averages of 0.39 million b/d (an increase of 17.5%) in 2019 and 0.56 million b/d (an increase of 44.6%) in 2020.

Likewise, refinery production of distillate fuel will increase from an average of 5.18 million b/d in 2018 to 5.32 million b/d (2.7%) in 2019 and 5.92 million b/d (11.3%) in 2020, while residual fuel refinery production will fall from 0.42 million b/d in 2018 to 0.40 million b/d (-5.7%) in 2020. As a result, U.S. distillate fuel net exports are forecast to increase to 1.8 million b/d in 2020, almost 0.6 million b/d (57.4%) higher than in 2018, as U.S. refiners export increasing amounts of IMO-compliant fuel to global bunkering hubs.

Based on the most recent data available, U.S. consumption of bunker fuel was about 0.3 million b/d, and EIA expects the overall effect on product supplied to be very small. In the bunker market, a modest shift from residual fuel use to distillate is likely. However, uncertainty exists regarding the IMO-compliant fuel specification and, in turn, what its supply chain will look like. As a result, the distribution of individual fuels is uncertain.

The EIA’s 2019 Annual Energy Outlook will reflect the long-term implications of the new sulfur requirements. Oil & Energy will include these projections in our upcoming March issue.