Cash flow, potential changes in basis, and local market dynamics should all be considered when weighing the protection of a hedge strategy against the cost of the option.

Christmas certainly came early this year for heating oil dealers. In the first few weeks of December, we enjoyed several weeks of both declining prices and cold temperatures, leading to higher-than-normal margins. As many business owners know, these bumps don’t typically last. Why do these swings in margin occur? And how can short-term hedges help prevent steep drops in profit?

Lagging on The Way up, Lagging on The Way Down …

Anecdotally, you may notice a lag exists between the change in rack prices and the change in your or your competitor’s retail prices. On the way up, dealers are reluctant to pass on costs to consumers. No one wants to be the first on the block to raise their posted price. On the way down, companies try to hold prices a bit longer to capture more margin. If customers paid that price yesterday, why wouldn’t they pay it today? Eventually, market dynamics take over, and margins return to normal. Price strategies and margin levels do differ significantly by company and by region. But season after season, we’ve seen this lag occur, leading to wider margins during falling prices and tighter margins during rising prices. With this phenomenon in mind, the threat to gross profits occurs during upswings in in prices. So, how can we tackle this recurring issue? On the retail side of the margin equation, differing too much from the average price in your area may lead to missed margin and/or missed gallons from price-conscious customers. Instead, we can focus on applying hedges to limit cost of goods sold (COGS). Trying to “time the market” in trading is usually an unsuccessful venture and adds unnecessary risk. A more prudent strategy to limit COGS would be to “time the margin” instead. We have several strategies to do just that.

Davey Heating Oil: November Scenario

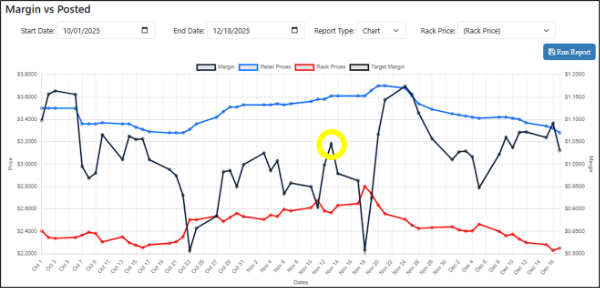

I’ve revived “Davey Heating Oil” from our previous weather derivative article for this example. I set the retail price based on a lag of NYMEX settlement prices and assumed a constant basis (the difference between the NYMEX price and my local rack price) of $0.10/gallon. I’ve also set a target margin of $0.95/gallon. Hey, if it’s a fake company with a fake margin, might as well make it a good one! I entered this scenario in MarginTrak, Hedge Solution’s software tool that we leverage to track basis, gross profit per gallon and even competitor prices for our clients. MarginTrak analysis helps us measure performance and identify opportunities to improve margins.

The graph below shows Davey Heating Oil’s retail price in blue, the local rack price in red and the resulting gross margin in black. Notice, as prices rose from early October to mid-November, margins took a hit. Seeing this and fearing a further uptick in NYMEX prices, I decided to explore short-term hedges to limit my exposure to higher costs. The key was to implement this hedge strategy when I saw a rise in my margin on November 13th.

Short-Term Strategies

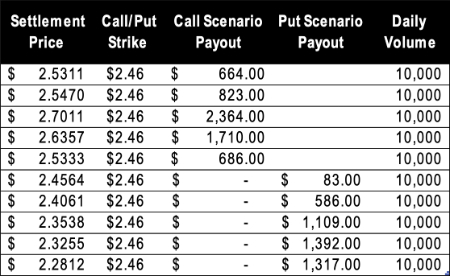

There are two short-term hedging strategies we can deploy. One is to purchase a ten-day call with a strike at the time of $2.46. The premium of the option was $0.06/gallon and the daily payout is the greater of the difference between the settlement price to the strike price, and zero. The total gallons are spread evenly and settled across the number of trading days in the period. In this example, the November 14th-28th call has 10 trading days. I estimated that I’d deliver 100,000 gallons during that time, making the daily settlement volume 10,000 gallons. The other strategy we could deploy would be to secure a 100,000-gallon bulk deal with a supplier at $2.56/gallon. Then, I would purchase a put with a $2.46 strike to cover against a fall in prices.

One added characteristic of this scenario is that basis is also locked in. See results of the two strategies in the payout table below:

So, why would I move forward with either of these strategies? Well, on November 13th, I’m sitting at $1.045/gallon margin, well above my target. The ten-day call or ten-day put were each priced at $0.06/gallon. That means, at worst, my margin drops $0.06/gallon compared to the base case. If the price goes up, I’m compensated in the call scenario with settlement payouts. In the put scenario, I’ve locked in supply at $2.56/gallon, meaning if my retail price rises, my margins will too. If the price goes down, my retail price will lag my rack costs, increasing my margin. In the put scenario, the option settlements will compensate me for supply costs at $2.56/gallon, which would be higher than the rack price.

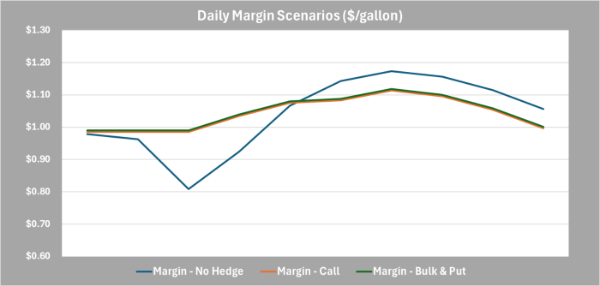

The $0.985/gallon margin was attractive, given that daily margins dropped as low as $0.81/gallon in late October due to rising prices. A strong rally could have sent them right back down to those levels. Instead, the rise in heating oil prices fizzled after a few days. The call and put scenarios still beat out the base case overall, by $0.0025/gallon and $0.0075/gallon, respectively. Sure, this is not a blockbuster result, but there are two things to consider while examining daily margin of the base case scenario (blue), call scenario (orange) and put scenario (green) the in the graph below. First, our goal was to capture our margin at or above our target, and we accomplished that. The price could have very well kept rising and our margin would have been well-below target. Second, the “No Hedge” scenario only beat out the hedging scenarios when the margins were well-above target. Sitting at $0.15/gallon over my target margin on day 7 in my hedged scenarios, I’m less worried about the missed extra $0.06/gallon gained in the base scenario.

When prices hover or go down, short term hedge overall profits don’t typically beat out the base case and the option premium eats into margins. Cash flow, potential changes in basis and local market dynamics should all be considered when weighing the protection the hedge provides versus the cost of the option. It always helps to have hedging-specific software for informed decision making as well as dedicated consultants to help detect opportunities to expand or lock-in profits.

Matt Davey is an Account Executive for Hedge Solutions working with consulting clients on hedging forward sales programs and purchasing oil and propane. He can be reached at: mdavey@hedgesolutions.com.